Cloud Cost-Saving Claims Questioned

(Hermin/Shutterstock)

Does the public cloud help companies save money? While cloud vendors like AWS tout cost savings as a major benefit, the question once again has come up for debate, especially among medium-sized and large companies that have relatively consistent growth.

AWS CEO Adam Selipsky made no bones about where the cloud giant stands on the question of cost. During his re:Invent keynote on Tuesday, he cited two AWS customers, both Fortune 500 firms, as evidence that the cloud can cut costs compared to running IT on-prem.

The first, Gilead Sciences, estimates that it will be saving more than $60 million over five years through a “strategic cloud adoption initiative,” according to the AWS CEO. The second, AGCO, has reduced costs by 78% “while at the same time increasing data retrieval speed,” Selipsky says.

“If you’re looking to tighten your belt, the cloud is the place to do it,” Selipsky said. “The cloud is more cost-effective and many customers are saving 30% or more.”

But the cost savings of the cloud don’t appear to be uniform across all companies, and there are many companies that report their costs have actually gone up after turning off their on-prem infrastructure and moving to the cloud.

David Heinemeier Hansson, the creator of Ruby on Rails, is moving two of his tech companies, Hey and Basecamp, off of the cloud and back on prem due to high cloud costs.

“We’ve seen all the cloud has to offer, and tried most of it. It’s finally time to conclude: Renting computers is (mostly) a bad deal for medium-sized companies like ours with stable growth,” Hansson wrote in an October 19 blog post titled “Why we’re leaving the cloud.” “The savings promised in reduced complexity never materialized. So we’re making our plans to leave.”

Hansson has used both Google Cloud and AWS for compute services for Hey (an email messaging app) and Basecamp (a project management app). They have run on everything from bare metal to Kubernetes, but have never been able to achieve the cost-savings that were promised.

Hey is currently paying $500,000 per year for a relational database and search services from AWS. “Yes, when you’re processing email for many tens of thousands of customers, there’s a lot of data to analyze and store, but this still strikes me as rather absurd,” Hansson wrote. “Do you know how many insanely beefy servers you could purchase on a budget of half a million dollars per year?”

The fact that AWS is reaping many billions of dollars in profit off its cloud operation also appears to irritate Hansson. Through the first nine months of the year, AWS reported $17.6 billion in operating income on $58.7 in revenues, or nearly a 30% gross profit margin, which Hansson called “obscene.”

The cloud makes sense at two ends of the spectrum: Small startups that face real financial obstacles in getting the IT talent and computing resources necessary to get a business off the ground, and organizations with highly irregular workloads.

“But neither of those two conditions apply to us today,” Hansson wrote. “Yet by continuing to operate in the cloud, we’re paying an at times almost absurd premium for the possibility that it could.”

Inflation has driven up the cost of everything, and computing is no exception. Cloud providers have increased the cost of their computing and storage services in reaction to these market forces.

For instance, Google Cloud announced a price increase earlier this year that will see storage costs go up by 25% to 50% in some cases, while API calls to the storage data plane will increase upwards of 400%. Moving data within the same region or the same continent, which used to be free at Google Cloud, is also now subject to a new data egress fee of two cents per gigabyte. It doesn’t sound like much, but those costs can easily account for hundreds of thousands of dollars in new costs for a busy application. AWS has also increased some fees, such as for spot instances, which can provide savings of as much as 80% over standard EC2 instances.

Customers are struggling to get their cloud costs under control, according to Anodot’s 2022 State of Cloud Cost Report, which was released in September. The report found that 49% of businesses surveyed “find it difficult to get cloud costs under control, and 54% believe their primary source of cloud waste is a lack of visibility into cloud usage,” the report states.

Vendors are beginning to respond. Teradata, which for years made a lucrative living as the Cadillac of on-prem data warehouses, has reinvented itself as a cloud-first data analytics provider. In August, the company released a new cloud data lake version of its warehouse, which it claims will help customers save money on cloud analytics projects.

More than 80% of cloud analytics customer go over budget by more than 50% in the first 18 months, according to Teradata CTO Stephen Brobst, citing a report. “They’re basically giving the vendor a blank check,” he told Datanami in August.

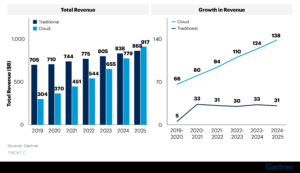

Gartner predicts cloud spending will surpass on-prem spending in three years (Source: Gartner, February 2022)

While the cost savings from running in the cloud continue to be debated, other advantages appear to be holding up. Security, once considered a liability for public clouds, is now touted as a benefit, particularly as cybercriminals get better at exploiting the tiniest of vulnerabilities.

It’s also hard to beat the smorgasbord of services available at the beck and call of cloud customers. AWS offers hundreds of data services, from automated machine learning and AI training to serverless Presto analytic environments and graph databases. When you factor in the ease of trying out third-party offerings in the various cloud marketplaces, it’s hard to argue that the cloud hasn’t become the ultimate place to test out new tech.

The flexibility of the cloud model is also an endearing strength, which Selipsky noted in his keynote address. He pointed out that before Covid-19, Airbnb was a pretty significant cloud user. When the bottom fell out of the hospitality industry in early 2020, Airbnb was able to scale down its usage rapidly, which is not something it could have done if it had been running its own gear.

“Airbnb was able to take down their cloud spending by 27%, and then when the world began to emerge from the worst of the pandemic, Airbnb was able to quickly turn on the cloud infrastructure that they needed to continue to drive innovation,” Selipsky said. “And you still do need to innovate, especially now.

Selipsky pointed out the results of a study that found migrating on premise workloads to AWS helped reduce customer’s time to market for new features by 43%, “with many customer achieving over 60% savings in time-to-market,” he said. “What this means is you want to be ready for anything–for operating efficiency, for flexible response to unexpected circumstances, and for innovating. The cloud gives you this capability.”

Just maybe not reduced costs for medium-to-large customers with steady workloads in the long run.

Related Items:

The Cloud Is Great for Data, Except for Those Super High Costs

Cloud Migrations Negatively Impacting Data Estates, Capital One Says

Cloud Getting Expensive? That’s By Design, But Don’t Blame the Clouds