Alternative Data Isn’t So Alternative Anymore

(Summit Art Creations/Shutterstock)

Don’t look now, but alternative data is quickly becoming a requirement for success, at least in the financial services industry. That’s the conclusion of recent studies that find interest in alternative data in the financial services industry is skyrocketing, and that spending on alternative data could soon outpace traditional data.

The definition for alternative data is not completely nailed down, but essentially it’s any type of data that doesn’t fit neatly into the boxes traditionally used for analytics. In the financial services industry, that means all of the data that’s not contained in things like quarterly and annual reports, press releases, and analyst reports. That puts data from credit card transactions, mobile devices, social media posts, satellite imagery, Web-scraped data, and geolocation data squarely in the purview of alternative data.

Use of alternative data started with hedge funds about a decade ago, but today all types of investors are using it. Most investors are looking to alternative data to gain a competitive edge over other investors, or to gain “alpha,” as they say. The huge demand led Bloomberg to add a feed for alternative data in its iconic terminal last fall.

In a 2023 report, Deloitte found that number of alternative data sets applicable to financial services increased by about 36% over the past two years, while the number of alternative data providers increased by about 30% over the same period.

Today, nearly all of the investors surveyed by Deloitte (98%) say alternative data is increasingly important for identifying alpha. That means that investors that don’t partake of alternative data increasingly find themselves at a disadvantage, Deloitte says.

“As the utilization of alternative data becomes mainstream, organizations that rely primarily on their traditional financial data for making investment decisions may be unable to make fully informed investment decisions,” the company says.

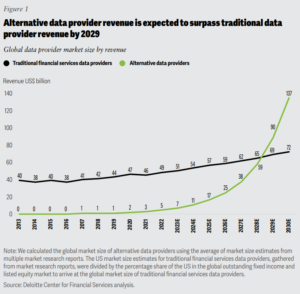

The interest in alternative data is driving a surge in sales by alternative data brokers. According to Deloitte, the nascent global market for alternative data was worth less than $1 billion as recently as 2016, but quickly sprouted into a $5 billion market by 2022. Deloitte projects the total value to skyrocket to $59 billion within five years, putting it at roughly the same value as the traditional data market. However, the growth trajectory for alternative data will take it well beyond $100 billion by 2030, Deloitte forecasts, riding a 29X growth rate and a CAGR (compound annual growth rate) approaching 60%

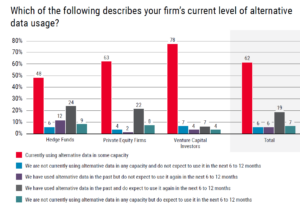

More data on the rapid uptake of alternative data comes to us from Lowenstein Sandler, a law firm that’s been surveying the use of alternative data among private equity funds, and venture capital funds for the past four years. The company last week released its latest report on alternative data, which concluded that use of alternative data has doubled from last year.

“The percentage of respondents currently using alternative data doubled from 31% last year to 62% this year,” the report’s authors wrote. “The greatest increase came from those in venture capital, with 78% reporting using it compared to 11% last year.”

Three out of four firms say they they’ll increase their spending on alternative data in 2024, with most increases in the 11% to 25% range. However, only about 28% of survey respondents say their budgets would increase by more than 25% this year, which was down from 65% last year. That led the firm to conclude that support for spending increases for alternative data appear to be waning.

Most of the firms surveyed by

–about 80%–are looking to spend from $100,000 to $2 million on acquiring alternative data this year, the survey found. About 10% of firms across hedge funds, private equity firms, and venture capital firms are looking to spend more than $3 million.

Most surveyed firms are looking to pair alternative data with AI, such as for streaming data analytics, predicting customer outcomes, finding insights, or automating routine tasks. About half of the firms surveyed say they’re currently evaluating AI and another quarter planning to implement it. Overall, about 16% of the firms surveyed by Lowenstein Sandler say they’re currently running AI atop alternative data, while only about 8% say they have no plans to use AI with it.

“Alternative data–with the help of AI–looks like it is here to stay, as evidenced by its increasingly accepted use by hedge, private equity, and venture capital fund managers searching for a competitive advantage,” said Scott Moss, a co-chair of the investment management and fund regulatory and compliance groups at Lowenstein Sandler. “On the other hand, budgets for alternative data may keep pace with its increased use as the market evolves.”

Alternative data can give companies an edge, but it’s not without its risks. The most cited risk of using alternative data were concerns about security breach issues, which was shared by about 38% of Lowenstein Sandler survey respondents. A lack of confidence in their ability to derive value from alternative data was next on the list at 34%. That same percentage feared their ability to extract relevant data from a large volume of alternative data, while 24% say they were concerned about regulatory scrutiny (24%).

Related Items:

Bloomberg Makes Alternative Data Accessible Alongside Traditional Financial Data

Alternative Data Goes Mainstream in Financial Services

From First to Third, and Alternative Too: A Guide to Data Types