Who’s Winning In the $17B AIOps and Observability Market

(Gorodenkoff/Shutterstock)

One of the hottest areas of big data at the moment is log monitoring and its adjacent disciplines, AIOps and cloud observability. The market, which some estimate is worth $17 billion per year, is in the midst of a transformation as smaller upstarts and startups aim to grab their share of the pie from big dogs.

Organizations today are under the gun to keep their IT infrastructure and applications up and running, and to minimize the amount of downtime they suffer. This, of course, has always been the goal, but it’s more difficult to achieve today due to modern architectures (microservices, containerization, hybrid-cloud deployments, growth of the edge) as well as the manner in which they are developed (agile DevOps techniques accelerated through sprints).

The huge volume of computer logs and metrics generated by today’s applications, and the increasing complexity of modern IT infrastructure, means special techniques are required to understand what’s going on. This often includes distributed storage and processing of the raw logs and metrics that are the basis of this space, as well as machine learning techniques for understanding patterns buried amid the noise.

These factors have combined to re-define the IT monitoring and management space. We’ve moved beyond simple log monitoring into the world of AI-powered operations (AIOps), which live within the broad realm of tools that provide full visibility of the entire problem space (observability, or cloud observability).

Security often is the leading application for AIOps and related tools, as IT staff seek to plug holes in constantly evolving applications that can be exploited by malware and malicious actors. Maintaining reliability and minimizing downtime are also high on the list. As companies digitize their operations, the number of employees looking for insight from data housed in logs and event data expands beyond the IT professionals to business analysts, line-of-business managers, and executives.

But keeping IT infrastructure up and running remains the number one focus. This is becoming increasingly difficult, thanks to the use of complex technologies, such as Docker and Kubernetes, that ostensibly are meant to make IT professional’s lives easier but create new monitoring and management challenges of their own. Today’s massive multi- and hybrid cloud deployments require new engineering skills, hence the surge in demand for site reliability engineers (SREs). Root-cause analysis and application performance management (APM) are also in the wheelhouse AIOps and observability wheelhouse.

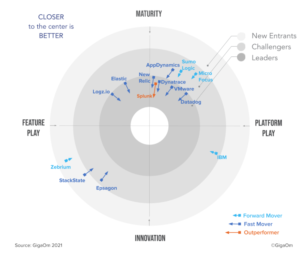

GigaOM recently published a Radar report on AIOps, observability, and log monitoring vendors (Source: GigaOM)

Here’s a rundown of the major players in the space:

Splunk (NASDAQ: SPLK), which was founded in 2003, was among the first vendor to gain a foothold in the modern AIOps/log monitoring/cloud observability stack and remains the giant in the field, with more than 15,000 paying customers for its proprietary offering. The company enjoyed $2.4 billion in revenue in 2020 and currently has a $23 billion market capitalization.

New Relic (NYSE: NEWR) was one of the first observability vendors to be born in the cloud. The company, which was founded in 2008, recorded nearly $600 million in revenue last year and claims to have more than 17,000 customers.

Dynatrace (NYSE: DE) was founded in 2005 and made its mark in the application performance management (APM) space. Today the publicly traded company, which had $487 million in revenues last year, is reinventing itself as a provider of an observability platform that supports a broad range of cloud and on-prem systems.

Datadog (NASDAQ: DDOG) which historically has focused on the security aspects of log management, provides a cloud-based monitoring service for on-prem and cloud-based infrastructure. The company, which had 9,000 customers when it went public in 2019, had $604 million in revenue in 2020, and today boasts a market cap of $27.6 billion.

Elastic (NYSE: ESTC) has risen to prominence on the back of Elastic Stack, the open source software that it develops. The company, which went public in 2018, boasts a customer base of 11,300, which generated about $427 million in revenue in 2020. It currently has a $11.8 billion market capitalization.

A recently published GigaOM Radar report lists several other big names competing in the overall cloud observability space, including IBM, VMware (part of Dell/EMC), Micro Focus, and AppDynamics, which was acquired by Cisco in 2017. That report, which you can see part of here, placed Splunk as the overall leader. Zebrium (“ML-driven RCA for logs and metrics”), StackState (“Topology and relationship-based observability”), and Epsagon (“instantly understand your microservices”) also made the cut.

“At the heart of the observability concept is a very basic premise: quickly learn what happens within your IT to avoid extended outages,” writes GigaOM analyst Andy Thurai in the report. “Outages are measured by Mean Time To Resolution (MTTR) and it is the goal of the observability concept to drive the MTTR value to as close to zero as possible.”

There are a handful of other young software and services companies in the AIOps, log monitoring, and observability business that have established bases and are now looking to expand their reach, including:

- Sumo Logic (NASDAQ: SUMO) develops a proprietary cloud-based AIops offering. The company, which went public in 2020, had $155 million in revenue last year and a market cap of $2.9 billion;

- Logz.io provides log management and security capabilities based on the ELK (Elastic, Logstash, and Kibana) stack and Grafana. The company, which was founded in 2014, has recorded $121.9 million in venture capital funding;

- Moogsoft builds an AI-driven observability platform that runs in the cloud. The company, which recently formed a partnership with Datadog, was founded in 2012 and has raised $92.9 million in venture capital funding’

- BigPanda develops software that helps IT professionals correlate event data and perform root cause analysis, with an aim of avoiding outages for applications running on-prem and in the cloud. The company was founded in 2012 and has raised $101 million in venture capital;

- Grafana Labs was founded in 2014 and builds dashboards for visualizing logs, metrics, and traces. It’s been widely used in the Elastic Stack, but also supports other storage repositories (it doesn’t store the data). Grafana has over 1,000 paying customers and has raised $75.2 million in venture capital funding.

A recent Forrester report on AIOps adds a few other vendors to the list. The analyst firms puts Dynatrace, Devo, and ScienceLogic as the leaders in Forrester Wave, followed by names like Zenoss, OpsRamp, Broadcom, Digitate, and LogicMonitor.

Devo touts its cloud-native logging, SIEM (security information and event management), and AIOps offerings. The company was founded in 2011 and has attracted $131 million in venture financing. ScienceLogic has been around a bit longer (founded in 2003) and develops what it terms a “context-infused AIOps platform.” The company has raised $214 million.

Zenoss, founded in 2005, boasts “full-stack SaaS-based monitoring combined with AIOps.” It has raised $53.1 million in VC funding. OpsRamp, founded in 2014, boasts “AIOPs-powered IT operations management [ITOM]) and has raised $57.5 million. Broadcom is the $24-billion semi-conductor manufacturer, but it also makes AIOps and observability software.

Digitate was founded in 2015 with the goal of using AI to “resolve operational woes” and create an “autonomous enterprise.” LogicMonitor, which develops a cloud observability platform, was founded in 2008 and acquired by Visa Equity Partners in 2018.

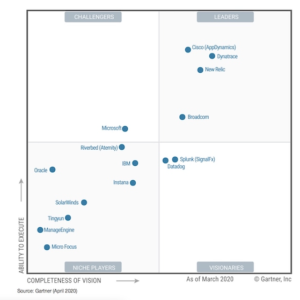

But wait, there’s more! A Gartner Magic Quadrant for APM adds a few additional names to the list, including Riverbed, ManageEngine, Instana, Microsoft, Oracle, Tingyun, and SolarWinds.

Riverbed developed a reputation for network management and WAN acceleration tools, but now it’s plying the observability waters too. ManageEngine built its reputation as a less expensive alternative to the Big Four IT management suites (you may remember BMC, CA, Hewlett-Packard, and IBM) in the early 2000s, and today the ZoHo subsidiary is going strong in AIOps. Instana was founded in 2015 as a specialist in APM and today it’s pivoting into observability for cloud-native apps. Tingyun operates mainly in the Asia Pacific region, but made Gartner’s list anyway. SolarWinds, meanwhile, is trying to rebuild its reputation following the security breach discovered in late 2020.

If you’re not totally overwhelmed already, then we’ve got a few additional names for you to consider. Last week, a called OpsCruise emerge from stealth with $5 million in seed funding. The company is specializing in providing observability to containerized applications.

Lastly, there is EraDB, which is building a Elasticsearch clone called EraSearch that it claims is more scalable and easier to use. We recently wrote about the company, which was founded in 2019 and has attracted $7 million in funding.

As you can see, the market for AIOps, log monitoring, and observability is rich and diverse, with lots of players seeking to differentiate themselves in specific parts of the stack. Several years ago, some observers thought the market was ripe for consolidation. There has been some consolidation. But the number of new entrants to the space, as well as established IT management firms pivoting into AIOps and cloud observability, would seem to have them outnumbered.

Related Items:

AIOps Emerges as ‘Air Traffic Control’ for IT

Why IT Ops Has Become Such a Rich Target for Big Data Analytics