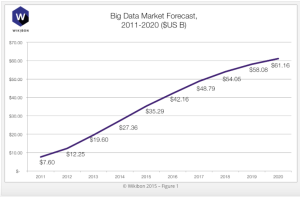

Booming Big Data Market Headed for $60B

The exploding big data market is expected to top $60 billion by the end of the decade, growing at an annual rate of 26 percent, according to a survey by the IT market tracker Wikibon.

Wikibon pegged the current big data market in a survey released this week at more than $27 billion, up from $19.6 billion in 2013. The estimates include big data-related hardware, software and professional services, it said. In a sign the big data market is coming into its own, the annual rate of growth actually slow by a third to 40 percent in 2014.

“This is to be expected in an emerging but quickly maturing market such as big data, and Wikibon does not believe this slightly slower growth rate indicates any structural market issues,” the researcher said in a summary of its market forecast and big data vendor revenue projections.

Among the drivers of the big data market is the emergence of big data warehouse “optimization” as a “definitive, initial big data use case applicable across vertical markets,” Wikibon concluded. It also cited maturing big data products and services in areas like data governance.

Another key driver is the embrace of big data analytics by at the highest levels of companies in vertical markets ranging from financial services and health care to retail and telecommunications.

Indeed, professional services were by far the big data market’s largest revenue generator in 2014, accounting for an estimated $10.4 billion in revenues, 43 percent of the annual total, Wikibon reported. Far behind was computing ($5.1 billion), storage ($4.4 billion) along with a combined “applications and analytics” category totaling just over $2 billion last year.

As for specific database services, SQL-based systems rang up an estimated $1.95 billion in revenues in 2014, followed by NoSQL systems ($223 million) and Hadoop ($187 million), Wikibon said.

Hardware, including compute, storage and networking, accounted for an estimated 37 percent of big data revenue in 2014. Most hardware revenues were associated with the sale of commodity servers with direct attached storage to support scaled-out Hadoop and other analytics database clusters, the market survey found. Top vendors included Cisco Systems, Dell, Hewlett-Packard, IBM and Intel.

Meanwhile, vendors such as IBM, Oracle, Red Hat and SAP led the $930 million data management sector while IBM, again, along with Cloudera, Hortonworks, and MapR spearheaded the Hadoop software market, the survey said.

NoSQL leaders included Amazon, Basho, Couchbase, MongoDB while HP, IBM, Microsoft, Oracle and Pivotal among others led the SQL market.

Nevertheless, Wikibon said professional service continues to account for the lion’s share of revenue in the maturing big data market. Among he leading practitioners are Accenture, IBM yet again, CapGemini and Deloitte. As big data software in the form of platforms and applications matures, making big data tools more accessible to new users, Wikibon expects the growth of professional services to tail off over the next five to ten years.

IBM remains the leader in big data revenues. According to Wikibon estimates, IBM’s big data revenues with 2014 sales topped $1.6 billion. Rounding out the top five were HP ($932 million), SAP ($923 million), Teradata ($687 million) and Dell ($685 million).

Recent items:

Big Data Rankings: Leaders Generated $6B in Revenues

Hadoop Market to Grow 25x by 2020, Reports Says