Data Fabric Firm Denodo Raises $336 Million

(CodexSerafinius/Shutterstock)

Data virtualization company Denodo bucked the overall tech investment slowdown today with news of a massive $336 million Series B round by a private equity firm.

Denodo Technologies traces its roots back to 1999, when Angel Viña, a professor at the University of A Coruña, had an idea on how to solve a data integration challenge that had bedeviled many over the years. Thus was born Denodo and its concept of data virtualization.

Instead of continually making copies of data for use in analytics or AI initiatives, as many organizations do today, Denodo advocates that customers use a form of data virtualization that allows them to use the data for analytics or data science purposes, but without copying it or physically moving it to a new location.

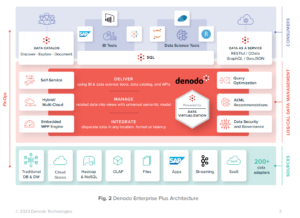

The company’s data virtualization technology fits into a larger data fabric offering, dubbed Denodo Enterprise, that provides users with governed, self-service access to disparate data sets. Denodo supports more than 200 data adapters for source data systems, including databases, file systems, cloud object stores, applications, and even Kafka streams. Browsing from an integrated data catalog, users can access this data for consumption in BI and data science tools via APIs, including REST and GraphQL.

The Palo Alto, California company claims that its data fabric offering can lead to significant savings, including a 400% return on investment (ROI) amounting to millions of dollars. Its approach has helped it land some premiere customers over the years, including Albertsons, Gilead, Logitech, Seagate, T-Mobile, and Volvo.

In recent years, the company has expanded internationally with new offices in South Korea, Sweden, and Thailand in 2022. At that time, the company had 25 offices spanning 20 countries. The new $336 million investment from TPG Growth, the “growth equity” arm of TPG Inc. (formerly Texas Pacific Group), will enable the company to keep expanding.

The investment by TPG Growth includes both primary capital as well as a secondary sale of shares by HGGC, the private equity firm backed by former NFL quarterback Steve Young that had previously invested in Denodo. The transaction is expected to close in early October as part of Denodo’s Series B preferred equity round.

Mike Zappert, a partner at TPG, says Denodo has established itself as a global leader in data management. “Denodo’s unique data virtualization software, which allows enterprises to create unified views of disparate data sources that can be queried easily without moving them, has powered impressive, profitable growth,” Zappert says.

Viña, the founder and CEO of Denodo, says he welcomes TPG’s investment, which he says will be used to accelerate global expansion.

“By investing in Denodo at this upward stage of our growth, TPG is demonstrating that it has strong confidence in our unique logical-first approach to data management, which simplifies the access and integration of all data assets in the corporate data estate to accelerate and democratize data usage, achieve higher levels of security and regulatory compliance, and dramatically improve operational efficiency,” Viña writes in a blog.

Related Items:

Data Fabrics Emerge to Soothe Cloud Data Management Nightmares

Four Steps to Transforming Your Organization with Data Virtualization

Data Mesh Vs. Data Fabric: Understanding the Differences