Big Growth Forecasted for Big Data

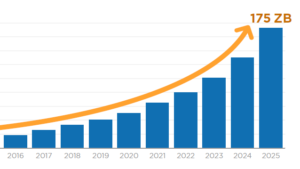

IDC says 175 ZB will be created by 2025 (Image courtesy IDC)

These are heady times to be in the big data business, with big growth predicted for the foreseeable future across several measures, including data generation and storage, market spending, and data analytics hiring.

First, the growth of data shows no signs of slowing down. In fact, data creation leaped forward in 2020 thanks to the COVID-19 pandemic, according to IDC’s DataSphere and StorageSphere reports.

However, out of the to 64.1 zettabytes (ZB) of data created in 2020, only 2% was saved or retained into 2021, IDC says. From 2020 to 2025, IDC forecasts new data creation to grow at a compound annual growth rate (CAGR) of 23%, resulting in approximately 175ZB of data creation by 2025.

“The amount of digital data created over the next five years will be greater than twice the amount of data created since the advent of digital storage,” Dave Reinsel, a senior vice president with IDC, said last March. “The question is: How much of it should be stored?”

The answer so far is: Not much. Per IDC’s figures, data storage trails data creation by about a 10 to one margin, with only 6.7ZB of installed storage capacity in 2020. Growth in storage capacity is predicted to grow at a 19.2% rate over the next five years, the analyst group says.

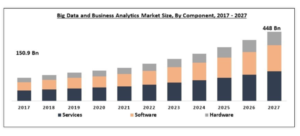

Research and Markets predicts a 13% CAGR in global big data spending from 2017 to 2027 (Image courtesy Research and Markets)

On the dollars and cents front, Research and Markets predicts the global big data and business analytics market to reach $448 billion in spending by 2027. That figure, which represents hardware and software spending, reflects a 13% CAGR from 2017 (when it was $151 billion) to 2027.

Among the factors driving growth, the company says, is “cutthroat competition” among companies to expand. A restraint on the growth of big data analytics, R&M says, is the cost of the solutions, the difficulty of use, and the specialized training it requires of practitioners.

That, of course, is great news for the folks who have the skills to work with data. According to a recent report from Burtch Works, 81% of US companies were planning to expand their data science, analytic, and engineering teams in the third quarter and fourth quarter of 2021.

Similarly, the number of people actively searching for data and analytics positions in late 2021 decreased dramatically as openings proliferated, according to the UK recruiter Harnham. “Vacancies are rising higher than the job seekers are looking for roles, which is really, really crazy to see,” Harnham’s Head of Marketing Owain Wood told Datanami in November.

In India, the rush to fill data roles is so great that 96% of firms are looking to hire data and analytics positions in 2022, according to a new report from Monster for that country. In fact, data analytics is positioned to be “the most in-demand role in 2022,” according to the report.

No matter how you slice it – data growth, market growth, or job growth – there’s a ton of stuff happening at the moment, which means it’s a great time to be in the data business.

Related Items:

Battle for Data Pros Heats Up as Burnout Builds

Data and AI Salaries Continue Upward March, O’Reilly Says

Global DataSphere to Hit 175 Zettabytes by 2025, IDC Says