The Data Proxy That Let CVS See Around the COVID Corner

(YES Market Media/Shutterstock)

When the economy went into lockdown from COVID last March, consumer demand shifted practically overnight, throwing retailers and their carefully planned supply chains into disarray. Like many retailers, CVS Health suffered from the turmoil. But by quickly pivoting its inventory planning system to use new data from alternative sources, or proxies, the company was able to re-locate the consumer signal amid the COVID noise.

For large retailers like CVS Health, which operates nearly 10,000 CVS Pharmacy locations across the United States, having accurate and reliable predictions is a critical element of success. If the $256-billion company fails to predict what customers will buy (not to mention the “when and where”), then it risks missing out on sales.

The disruption to store operations from COVID a year ago was profound, and the company recognized immediately that it would need a new approach to data analysis, according to Taras Gorishnyy, vice president of enterprise retail analysis at CVS Health.

“When everything shut down, for us to understand the demand for the most basic and necessary items, like hand sanitizers, there was no historical signal to predict that,” Gorishnyy said in a recent webinar with WorldQuant Predictive, the data analytics company it hired to help it through COVID (Datanami moderated the discussion).

Historical sales are among the biggest ingredient that goes into these store-level stock keeping unit (SKU) predictions. However, because COVID was such an unprecedented event and led to so-called “panic buying” among customers, CVS could not extrapolate demand for some items from historical buying patterns.

That set CVS out on its search for new data sources, Gorishnyy said. “We needed to start learning very quickly from the changes that were happening in real time,” he said. “A big part of it was just understanding….in the universe of data that’s outside of our own company, what are the data elements that capture the new normal of the consumer behavior and how they have changed”?

WorldQuant Predictive had experience finding “alpha signals” for companies in the financial services market, and it used these data techniques to help CVS find new data sources to plug into its predictive models, said Jim Golden, the CEO of WorldQuant Predictive (WQP).

“Our real goal is to say where do interesting sources of data exist and how can we build models that allow us to predict the future with some accuracy, but also really at scale,” Golden said during the webinar, which was called “Seeing Around the Corner: Proxies During a Pandemic.”

“Panic buying” during the first days of COVID shocked the consumer-goods supply chain (Steeve-Raye/Shutterstock)

The folks at WQP modified their traditional data analysis techniques in its engagement with CVS, said Robert Molnar, WQP’s director for predictive retail and consumer packaged goods (CPG).

“We were in the business of creating unusually accurate predictions even before COVID-19 hit,” Molnar said during the webinar. “But at the onset of the pandemic…we realized that we need to become even more accurate than previously, because there was massive disruption.”

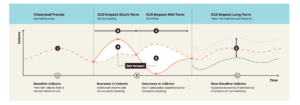

The analytics professionals were well aware of the “pantry loading” behavior, in which consumers stock up on shelf-stable items. But they also observed that buying patterns were changing in the long term too, and they had to factor this into their equations.

“The panic buying effect for certain product categories kicked in, followed by what’s called a deep effect, meaning that people actually stock up more than they need, so there’s a decline versus normal seasonal sales following,” said Molnar, who worked close with Gorishnyy and his team at CVS. “But in some product categories, we actually found the opposite, that a pantry loading effect kind of persisted, meaning that people tend to consume more. The behavior changed fundamentally.”

The challenge, then, was to find new sources of data that could serve as a reliable predictor of demand amid this fundamental shift. WQP helped CVS find these alternative data sets, and incorporate them as proxies into the CVS demand models.

The companies started small at first, seeking to predict demand for just a handful of SKUs for stores nationwide. Initially, they looked at several dozen alternative data sets to incorporate into the new model. But eventually they settled on several sources, including real estate data from Zillow; infection data from Johns Hopkins and the New York Times; employment data from the Department of Labor; news data from the GDELT Project, and Descartes Lab, among others.

The Zillow data, surprisingly, turned out to be one of the most promising proxies for CVS. As WQP notes, while the number of homes sold during “shelter in place” dropped, home prices largely held up. As time went on, WQP found a correlation between strong real estate prices and customer buying behavior in specific CVS stores.

COVID triggered a permanent shift in buying patterns (Image courtesy WQP whitepaper “Seeing Around the Corner: Proxies During a Pandemic.””)

Led by the Zillow data, CVS was able to dial in its demand model to a very high degree. According to Gorishnyy, the company’s models were able to predict actual demand within plus or minus 2%.

“That’s very, very hard to do in general,” Gorishnyy said, “and it’s especially hard to do during the pandemic.”

What’s more, CVS also used the Zillow data to create a set of “early warning” indicators that the company could use to determine when it was likely there would be a surge or a dip in sales, enabling the company to take prescriptive action.

All of the data sources used by CVS are commonly available, and most of them are free. Golden encourages other companies to take a broad view in seeking new data to incorporate into their models.

“When we work and talk to other potential clients, there’s a lot of data out there that you may not be looking at,” he said. “There’s a lot of history in places like Wall Street, with the hedge funds or private equity firms, that gathered data that can be very, very informative for companies themselves.”

As the COVID vaccines are distributed and restrictions are lifted, there will be ample opportunity to expand the use of data. We are on the cusp of an economic boom in this country, with GDP forecast to grow between 5% and 7%. The companies that use data to help gauge when and where demand will show up will be the ones who benefit the most from that economic uplift.

CVS leveraged new data sources to achieve a demand model accurate within 2% (MONOPOLY919/Shutterstock)

“We had another client that came to us and said, commercial real estate has obviously been very badly hit,” Golden said. “What does this mean for people’s behavior for going back to offices? When do offices open up, how does that affect restaurants and shopping centers and the individuals and groups that actually served those communities in those office buildings?

“For us, nothing is really going be the same again,” he continued. “How do we build better, more accurate, and more resilient models of consumer behavior?”

Specifically, for companies in the CPG supply chain, COVID was a wakeup call. The old tradeoffs that demand planners used to make between the efficiency of their supply chain and its resiliency will need to be re-calculated.

“If anything really, this pandemic served as a catalyst for companies to realize that they need to become a bit more data driven–or in many cases a lot more data driven, because the supply chain suffers greatly if not,” Molnar said.

“Historically it was all about keeping inventory stocks a minimum and trying to adopt a just-in-time model,” he continued. “But obviously, when a disruption happens…then these efficient but fragile supply chains get disrupted. And if you don’t have a data-driven system to compensate for that really quickly, then you’re going to suffer.”

To view the entire “Proxies During a Pandemic: Using Data Analytics to ‘See Around Corners” or to read the associated white paper, click here.

Related Items:

How AI Is Helping the Supply Chain Cope With COVID-19

A Race Against Time to Model COVID-19

8 Ways AI Can Boost Retail Sales During the COVID Holida