Microsoft Surges in Gartner Quadrant with Power BI

Microsoft is the new king of the hill when it comes to business intelligence and analytics platforms, at least according to the latest Magic Quadrant from Gartner, which placed the Power BI backer in the pole position. The analyst group also had some interesting things to say about visual data discovery tools being disrupted by machine learning-based ones.

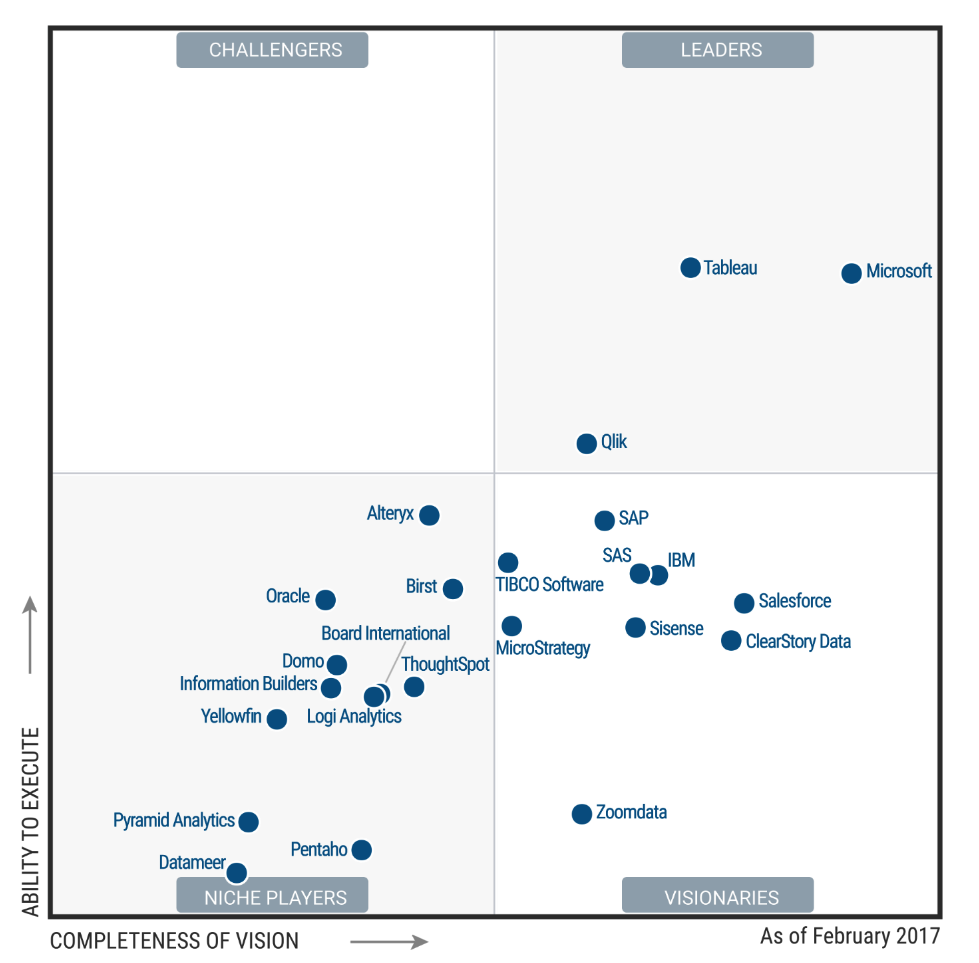

The rise to the top of the Leaders Quadrant was relatively swift for Microsoft, which now has shared that special box with competitors Tableau Software and Qlik for the past two years, following exits by MicroStrategy, Oracle, IBM, SAP, SAS, and Info Builders into other, shall we say “less privileged” quadrants following the 2015 edition of the popular report.

The combination of sales slowdowns for the two pure-play BI and analytic vendors that manifested early last year—along with price cuts and continued development in PowerBI—was enough to propel Microsoft to the much vaunted position in the quadrant–although to be fair, Tableau owns a greater ability to execute and sits a smidgen higher along the Y axis than Microsoft, which you can see below, and in this reprint (courtesy of Tableau)

Gartner says Microsoft is winning by “placing downward pricing pressure on the BI and analytics market.” It notes that a Power BI license is one-third the cost of a perpetual license for other tools, and 80% lower than other cloud offerings (PowerBI is only available in the cloud). As long as you can stay under the 10GB limit, the price of PowerBI stays very low.

The software also scores well in the ease-of-use and complexity of analysis categories. Gartner also lauded PowerBI’s capability to manipulate data from multiple data sources, such as Hadoop and relational databases residing in the cloud or on-prem.

Here’s what Gartner had to say about it: “Microsoft is positioned in the Leaders quadrant again this year, with continued strong uptake of Power BI, accelerated customer interest and adoption, and a clear and visionary product roadmap that includes vertical industry content.”

Gartner’s 2017 Magic Quadrant for Business Intelligence and Analytics Platforms

That’s not to say that Tableau and Qlik—or any of the other BI and analytic tool vendors for that matter—are out of the fight. In fact, there is probably more parity now in the BI market than there has been for quite a while. And then there’s the fact that Gartner still touts Tableau as “the gold standard for intuitive interactive exploration.”

That focus on visualization is one of the defining elements of the shifts that have occurred in the BI and analytic tool markets. “As the visual-based exploration paradigm has become mainstream, a new innovation wave is emerging that has the potential to be as disruptive as (or more than) visual-based data discovery has been to the previous semantic-layer-based development approach of traditional BI and analytics platforms,” the analyst firm writes.

While analysts love using their visualization tools to spot patterns in the data, Gartner sees “smart data discovery” powered by machine learning algorithms as the trend of the future. Ironically, Gartner sees the semantic-layer leaders like IBM and SAP, who were displaced by the visual-first analytic vendors like Tableau, Qlik, and TIBCO Spotfire, leading the wave to displace the visualization vendors. What goes around, comes around, as they say.

Other notable changes from the 2016 magic quadrant include the addition of Zoomdata to the mix. The company, which leverages in-memory Apache Spark technology to enable the visual analysis of streaming data, debuted in the Visionaries quadrant, which is also home to BI bigwigs like IBM, SAS, SAP, TIBCO, and Microstrategy, as well as newer firms like ClearStory Data, Sisense, and BeyondCore (acquired by Salesforce).

Analytic vendors that dropped a bit in the standings (by going from the Visionaries quadrant to the Niche Players quadrant) include Alteryx, LogiAnalytics, and Pentaho. Datameer and ThoughtSpot also debuted in the Niche Players quadrant, while Gooddata disappeared from the list.

And for the second straight year, there were no BI/analytic tool vendors in the Challengers quadrant.

Related Items:

Tumultuous Times for BI and Analytic Tool Vendors

Rating the Advanced Analytics Vendors