Object Storage Ecosystem Grows While Standardizing and Consolidating, IDC Says

(Jezper/Shutterstock)

The object storage system landscape has changed dramatically in the past year thanks to consolidation of the players involved and technological standardization, IDC says in its latest report.

Object-based storage systems are growing in popularity thanks to their nearly unlimited storage scalability and greater flexibility compared to traditional file systems. Over the next three years, IDC sees object-based storage (OBS) capacity growing at 30.7% annually, accounting for a whopping 293.7 exabytes of storage by 2020.

Much of this growth will be fueled by expanding use cases for OBS. Organizations that have deployed OBS have typically used it to back up or archive huge data sets measured in the dozens of petabytes to exabytes. But increasingly, IDC sees OBS expanding out into analytics, HPC, mobile, and compliance projects.

In its latest MarketScape report on object storage systems, IDC analyst Amita Potnis sliced and diced the market changes over the past year. She noted that the landscape “has changed dramatically–a fragmented OBS market has now somewhat consolidated.” Mainstream storage vendors are looking to get into the OBS space, either by developing them in-house or through acquisition.

Technical standardization is also a trend to keep an eye out for in the OBS marketplace. In particular, the Amazon S3 and OpenStack Swift APIs have been chosen by the market as standard ways to access OBS repositories, Potnis writes in the December report.

This demonstrates the enormous popularity of those cloud-based storage repositories. It will also likely bolster the overall market as fear of technological obsolescence decreases and potential users see OBS as less risk investments than before.

The rise of OBS solutions running on all-flash arrays has also caught the market’s attention, particularly for running big data analytics, rich media, and technical computing (i.e. HPC), Potnis writes. In particular, customers are looking to custom-flash modules (CFM), as opposed to solid state drives (SSDs), to give them an edge in scalability and cost-per-gigabyte, she writes.

Customers shopping for OBS would do well to consider IDC’s guidance on the products. The analyst group advises potential OBS users to consider an automated information lifecycle management as a requirement, and to look for OBS solutions that exhibit a strong hardware and software partnership. Scalability should be measured not just in raw storage capacity but also in terms of throughput, the IDC says.

Another important aspect of OBS solutions that potential buyers should look for are the sophistication of data reduction technologies, such as erasure encoding and data de-duplication. Erasure encoding is also critical for good data resiliency. Lastly, a good OBS solution will also have built-in data management and reporting software.

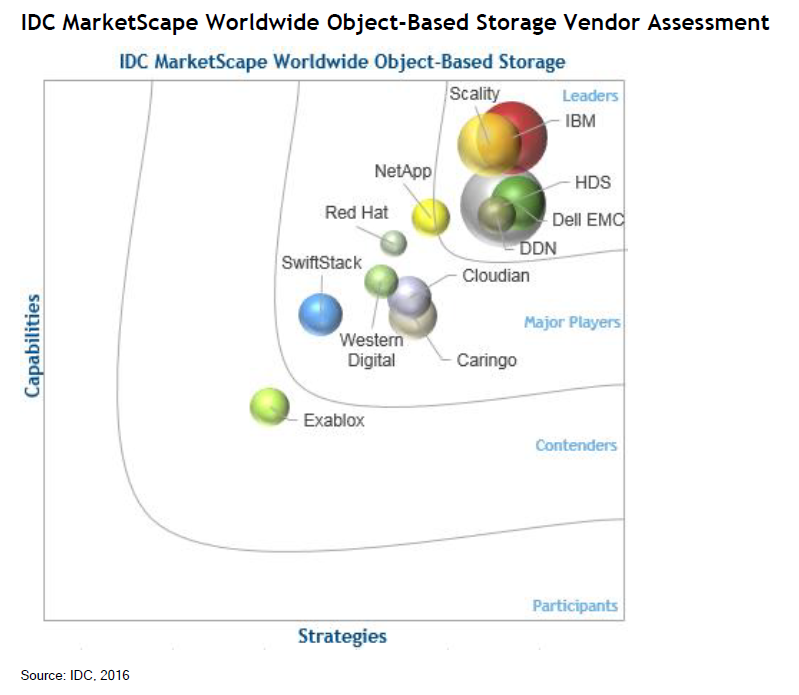

IDC placed IBM, Scality, Hitachi Data Systems, Dell EMC, and DDN in the Leaders section of its MarketScape ratings system, which omitted cloud-based offerings. NetApp, Red Hat, Cloudian, Caringo, Western Digital, and SwiftStack are Major Players, while Exablox is placed in the Contenders section.

IDC projects the OBS market to reach $19.8 billion in 2020. Much of it will be driven by hyperscale environments, the company says.

Related Items:

Hitachi Adds Enterprise Search to Object Store

DDN in Product Line Refresh, Multi-level Security for Lustre

Is Spinning Disk Going Extinct? Experts Weigh In