Google Cloud Waives Cloud Exit Fees, Throws Down Gauntlet to AWS and Azure

(Rawpixel.com/Shutterstock)

In a bold move by the number three public cloud company yesterday, Google Cloud announced it will no longer charge customers extra to move their data out of its data centers, making it the first public cloud company to eliminate the burdensome exit fees.

While public cloud companies don’t charge a penny to move data in, they have all charged fees to move the data out. These cloud exit fees have been a widespread if controversial practice by public cloud providers for many years, and have helped the public clouds gain a reputation for anti-competitive business practices.

With yesterday’s announcement, Google Cloud becomes the first major cloud provider to buck that trend and open the door for customers to move their data out free of charge.

“Starting today, Google Cloud customers who wish to stop using Google Cloud and migrate their data to another cloud provider and/or on premises, can take advantage of free network data transfer to migrate their data out of Google Cloud,” Amit Zavery, who holds the titles of general manager, vice president and head of platform for Google Cloud, wrote in a blog post. “This applies to all customers globally.”

“Eliminating data transfer fees for switching cloud providers will make it easier for customers to change their cloud provider,” Zavery continued. “However, it does not solve the fundamental issue that prevents many customers from working with their preferred cloud provider in the first place: restrictive and unfair licensing practices.”

Google is now essentially daring its customers to move their data out. It’s essentially thrown down the gauntlet to rivals Microsoft Azure and AWS by saying it no longer must rely on artificial means to retain customers and can beat Azure and AWS on the quality of its services alone.

“Making it easier for customers to move from one provider to another does little to improve choice if customers remain locked in with restrictive licenses,” Zavery said. “Customers should choose a cloud provider because it makes sense for their business, not because their legacy provider has locked them in with overly restrictive contracting terms or punitive licensing practices.”

Rising costs of cloud data storage and computing has become an important issue for companies since the Covid-19 pandemic spurred a massive migration to the cloud. Many companies, expecting cost savings in the cloud, have complained about large and unexpected costs.

In a 2022 survey by Forrester for Capital One Software, 82% of companies reported cloud forecasting and controlling costs as challenges. “What was once meticulously planned and budgeted on-premises, is now unpredictable,” Forrester said in the report.

Cloud exit fees, or egress fees as they’re often called, are not always transparent and can be tough to predict, according to Cloudflare, a provider of Web performance and security solutions. “Understanding the line-by-line charges for egress can require some depth of application architecture and cloud infrastructure expertise, which not all organizations have,” the company says.

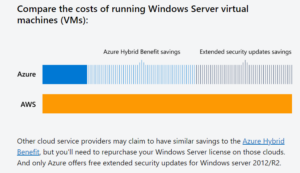

Microsoft Azure says it can run Windows Server 5x cheaper than AWS (Source: Microsoft Azure website)

In a thinly veiled dig at Microsoft, Googel Cloud’s Zavery alleged that “Certain legacy providers leverage their on-premises software monopolies to create cloud monopolies, using restrictive licensing practices that lock in customers and warp competition.”

This statement was a direct reference to Microsoft’s prohibition on allowing its Office 365 software to run on Google Cloud or Alibaba Cloud; it made a deal with AWS to allow to run the software. (Zavery’s link to an August story in The Register helped make the point clearer.)

Google Cloud also hinted that it would encourage regulators to take up the issue of anticompetitive business practices among cloud providers, which extend beyond the data exit fees. Zavery wrote:

“The complex web of licensing restrictions includes picking and choosing who their customers can work with and how; charging 5x the cost if customers decide to use certain competitors’ clouds; and limiting interoperability of must-have software with competitors’ cloud infrastructure,” Zavery wrote. “These and other restrictions have no technical basis and may impose a 300% cost increase to customers. In contrast, the cost for customers to migrate data out of a cloud provider is minimal.”

Zavery linked to a Microsoft Azure Web page that claimed running Windows Server on Azure virtual machines was five times less expensive than running the equivalent setup on Azure. The Web page stated that a customer running Windows Server on Azure would get the “Azure Hybrid Benefit to pay reduced compute rate” as well as “free security updates for Windows Server 2012 and 2012 R2 VMs. The AWS customer, on the other hand, would be forced to “use Windows Server Reserved Instances rate under standard 3-year term with monthly payments,” as well as the standard extended security update (ESU) cost for security.

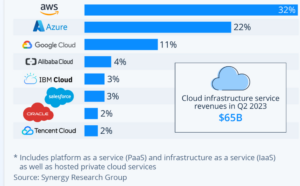

It will be interesting to see the responses of AWS and Microsoft Azure, which are the biggest and second biggest public cloud providers, respectively, and together control 55% of the market for public cloud services, according to an August report by Statista using data from Synergy Research Group. Google Cloud was the third biggest cloud provider with an 11% share of the market, the report said.

“We will continue to be vocal in our efforts to advocate on behalf of our cloud customers–many of whom raise concerns about legacy providers’ licensing restrictions directly with us,” Zavery said. “Much more must be done to end the restrictive licensing practices that are the true barrier to customer choice and competition in the cloud market.”

Related Items:

The High Costs of Going Cloud-Native

The Cloud Is Great for Data, Except for Those Super High Costs

Cloud Migrations Negatively Impacting Data Estates, Capital One Says