Five AWS Predictions as re:Invent 2023 Kicks Off

(Michael Vi/Shutterstock)

The computing world this week turns to Amazon Web Services, the company that originally defined the public cloud space and continues to enjoy the largest slice of the cloud pie. Its annual re:Invent conference, which kicked off Monday in Las Vegas, is sure to be a celebration of all things AWS and cloud.

But there are some, uh, clouds on the horizon, as AWS no longer enjoys the dominant position that it once held. As competitors improve their offerings, as workloads shift, and as the economy oscillates, AWS’s once-relentless growth has slowed, as evident in the revenue figures reported to Wall Street.

For the past two quarters, AWS’s revenue growth has come in at 12% above the corresponding figure from the year-before quarter. That is down from the 16% revenue growth it delivered in the first quarter of the year, and the 20% growth seen in last quarter of 2022. The two previous quarters before that revenue growth topping 27.5% and 33%, respectively.

Twelve percent is nothing to sneeze at, as the company is still throwing off a huge amount of cash for its parent company. There’s no indication that Andy Jassy, the former AWS CEO who was named CEO of the parent company in January 2021, is ready to pull the fire alarm just yet, although he is clearly worried about costs, for both Amazon and its customers.

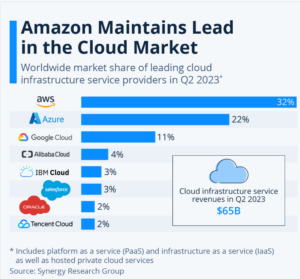

AWS’s position relative to its biggest competitors, Microsoft Azure and Google Cloud, has slipped. According to Synergy Research Group, AWS enjoyed a 32% share of the $65 billion public cloud market in the second quarter of 2023, down from 34% from 2022. AWS’s loss was Microsoft Azure’s and Google Cloud’s gain, as each saw their share increase by one percentage point, to 22% and 11%, respectively.

AWS is still in the pole position as the cloud continues to expand overall. It has a strong dedication to innovation, thanks to its “two pizza” rule and lack of top-down bureacracy that has slowed tech giants of the past (we’re looking at you, IBM). The odds that AWS lays down and lets Microsoft continue to take share are somewhere between slim and none.

Here are five areas where AWS is likely to be active this week as it seeks to reclaim share and capture new business in emerging markets.

1. Optimized Cloud Spending

One of the biggest concerns facing cloud providers like AWS is the frustration that many customers feel when they receive an unexpectedly high cloud bill. While there doesn’t appear to be a huge movement back on-prem, reports of customers pulling their workloads off the cloud and hosting them on their own servers doesn’t help appearances for AWS and company.

AWS, like all cloud companies, gets paid more when customers use more compute and store more data. It’s clearly in AWS’s interest to get customers to expand their workloads, whatever it is. But it’s also in AWS’s interest not to alienate customers with services that are difficult to tune and result in surprise bills.

Jassy is well aware of the dynamic and its potential impact to the company’s top and bottom lines. In a recent conference call with analysts, the Amazon CEO noted that customers have “needed assistance cost optimizing to withstand this challenging time.” Adam Selipsky, his successor as AWS CEO, will undoubtedly mention this during his keynote address Tuesday morning (which you can watch here).

re:Invent Prediction: Expect AWS to make cost-optimization a major focus with its announcements this week.

2. More GenAI, Please

Unless you’ve been hiding under a rock since November 30, 2022–the day that OpenAI launched ChatGPT and the last day of re:Invent 2022–you’re probably well aware that generative AI is well on its way to taking over the world. (Well, maybe not quite, but it feels that way sometimes, thanks to the relentless hype and drama.)

The good news for AWS is that training large language models (LLMs) and other types of foundation models requires very large stores of data and consumes massive amounts of compute. For builders looking to train and host their own AI models on AWS, it’s a win-win situation–or make that “win-win-wind,” as without the tailwind of GenAI, the 12% revenue growth for the most recent quarter would probably have been lower).

But whereas Microsoft has its close partnership with OpenAI and Google has its own set of AI offerings–and hey, let’s not forget that it was Google that invented the transformer model–AWS has been a little bit late to the GenAI game. Its flagship GenAI offering, Amazon Bedrock, didn’t become generally available until September.

re:Invent Prediction: AWS will undoubtedly make Amazon Bedrock a core component of its GenAI news this week. Expect to hear a lot about GenAI more broadly, too, including in Sagemaker and its industry-specific offerings for call centers, healthcare, and other businesses. (And oh, if you’re in Las Vegas this week, move some chips over to “AWS will definitely launch its own vector database.” You’re welcome.)

3. The Great GPU Squeeze

The surge of interest in GenAI has triggered huge demand for GPUs, which are needed to train and fine-tune LLMs. This has been great news for Nvidia, which has seen its market capitalization exceed $1 trillion for the first time on the back of the GenAI craze, and its helped drive innovation at the chip level too. However, demand for GPUs has outpaced supply. It’s a situation that Doug Eadline, the managing editor of Datanami’s sister publication, HPCwire, dubbed “The Great GPU Squeeze.”

AWS has responded to the Great GPU Squeeze with new compute offerings. On Halloween, it launched Elastic Compute Cloud (EC2) Capacity Blocks for ML, which they can use with P5 instances powered by NVIDIA H100 Tensor Core GPUs. The new offering enables customers to reserve GPU capacity for short durations to run their ML workloads, eliminating the need to hold onto GPU capacity when not in use.

AWS has also been active in developing its own silicon, particularly its Graviton chip, which is useful for running training and inference workloads for traditional machine learning workloads, but, alas, not for LLMs.

re:Invent Prediction: AWS is all about enabling builders, but GenAI builders can’t build when compute isn’t available. Expect AWS to innovate with new EC2 instances and possibly new silicon to augment GPUs.

4. I Want My Hybrid Cloud

Surveys indicate a large majority of companies are planning to run their IT using the hybrid cloud model. That is, they won’t put all of their digital eggs in a single cloud basket, and instead will spread them out over multiple clouds.

This is smart, as it gives large enterprises an edge in negotiations (nobody of any size pays list price for compute, storage, and networking in the cloud) and it helps them to push back against lock-in. All public cloud vendors secretly want lock-in, because it boosts their revenues and diminishes churn, even if they claim the opposite.

AWS isn’t any better or worse than other clouds when it comes to lock-in, but if the company is serious about the relentless focus on cost-optimization and helping customers optimize their AWS spend, then it should do more to help workloads become more liquid. The good news is that emerging standards like Kubernetes (at the container level) and Apache Iceberg (at the data format level) help to grease the wheels for hybrid compute, giving customers more freedom to move data and workloads to where they can have the greatest impact.

re:Invent Prediction: AWS will deliver more capabilities to support its customers’ hybrid cloud ambitions, making it easier to move data and workloads–particularly when it comes to moving data and workloads off competing clouds.

5. Data Management or Bust

A funny thing happened on the way to GenAI: The world realized that good data management was a necessity to achieving GenAI goals. That old adage “garbage in, garbage out” has never been truer.

The good news is AWS has a plethora of data management capabilities. The company offers just about every type of database known to man as an AWS service (well, not a vector database–not yet). If you widen your aperture to include partner offerings, then there are exactly zero data management capabilities you can’t get in the AWS cloud.

But AWS wants customers to use its in-house products, which typically (although not always) come with better integration with other components of the AWS stack. Last year, AWS launched the DataZone, which brought data catalogs, data governance, data sharing, and data discovery capabilities. It also bolstered Glue with new data quality and observability capabilities, debuted zero-ETL capabilities in RedShift, and launched other new services, like a security lake and clean rooms.

re:Invent Prediction: This isn’t the time to back down on data management, especially with new regulations coming for AI. Expect AWS to give customers even more capabilities for managing, governing, and securing their data in the AWS cloud.

Related Items:

AWS Bolsters Glue ETL Tool with Data Observability, Ray Support

AWS Introduces Amazon Security Lake and AWS Clean Rooms