Report Finds Alternative Financial Data in Lending Could Help ‘Credit Invisibles’

Credit bureau reports have been the cornerstone of traditional underwriting practices, yet they exclude millions of consumers from credit and financial services due to the sometimes incomplete nature of the current system. Equifax estimates that 91.5 million U.S. consumers either have no credit file or have insufficient information in their credit file, leaving “credit invisibles,” like young people just entering the workforce or recent immigrants, without as many financial options.

There may be an industry-wide sea change ahead thanks to big data. A new report sponsored by fintech company Nova Credit, “The State of Alternative Data in Lending,” looks at how lenders are currently using alternative data in underwriting for credit risk assessment and what the future may hold for these practices.

Alternative data is any non-standard piece of data that can be used to inform decision-making. Much of the data in question in this case is considered consumer-permissioned data, which is defined by Equifax as transactional and account-level information that a consumer gives a business permission to access on their behalf. This alternative data can include cash flow, transactional data, rent and utility payments, and income or employment verification.

Nova Credit says the credit risk industry has taken small steps towards more inclusive underwriting by including alternative data in the lending process to provide an enhanced view of consumer affordability, likelihood to pay, and both immediate and long-term risk.

The report found that 74% of lenders believe traditional credit report data does not reveal the complete picture of consumer creditworthiness, and 59% are turning to alternative data sources to fill in the gap during the underwriting process. Additionally, 50% of lenders are ready to adopt alternative consumer data into their credit risk assessments and 39% are in the early stages of adoption.

“Alternative data, such as cash flow underwriting, provides an enhanced toolkit to holistically manage credit risk for mainstream and credit-excluded consumers by clarifying whether the consumer has the capacity to afford a loan based on the financial health of their bank account and also whether the consumer is likely to repay the loan given the availability of funds,” the report says. “Incorporating alternative data into underwriting practices not only enhances the lender’s capacity to accurately assess consumer credit risk, but has the potential to end the very idea of a credit-excluded population in the United States.”

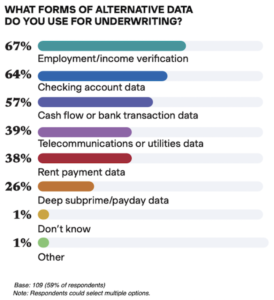

The report’s other key findings include how some forms of alternative data are already being tapped by some lenders, such as non-transaction checking account data (64%), employment and income verification data (67%), and cash flow or bank transaction data (57%). However, data related to utility payments, rent payments, and deep subprime loans are presently underutilized and were cited by less than 40% of respondents.

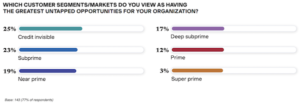

Another insight uncovered by the report is how few lenders are currently using alternative data sources to reach new lending audiences. Though 90% believe in the potential of this data for reaching new consumer segments, in practice, this was only a current motivator for 27% of lenders surveyed, with 51% citing improved predictability as their main incentive.

Many lenders have concerns about adopting these new data sources for credit risk assessment, including the reliability and stability of alternative data (48%) and its associated costs (37%). Even companies who have already begun adopting alternative data have concerns about the data and analytics costs (41%) and 37% reported that understanding how best to incorporate it into their existing framework was another top challenge.

Nearly 75% of lenders surveyed have started considering cash flow data in the past two years, which Nova Credit says represents a shift in how they think about underwriting models and the benefits of consumer-permissioned data. The company also believes this indicates that the industry is on the brink of a significant shift, with 65% of lenders expecting it will be ready to adopt alternative data within five years.

“The lending industry is on the precipice of major change, coming to terms with outdated underwriting processes and seeing opportunity with new data sources that will help them improve predictably, reach new customers and grow even in the face of economic uncertainty,” said Misha Esipov, co-founder and CEO of Nova Credit. “This research underscores Nova Credit’s long held belief that alternative data sources are the path to creating a more fair and inclusive credit reporting system and it is rewarding to see progress being made in the industry to do just that.”

Nova Credit is a consumer-permissioned credit bureau that translates international credit data into a local-equivalent score to help “credit invisible” newcomers access credit upon arrival in a new country of residence. The study was conducted in partnership with independent research firm Researchscape and is based on a survey of 185 decision makers in the lending industry. Read the full report here.

Related Items:

Alternative Data Goes Mainstream in Financial Services

Equifax Launches TotalVerify Data Hub

Explorium Nets $75 Million to Grow Alternative Data Platform