Digital Transformation Trumped Data During COVID: KPMG

(CeltStudio/Shutterstock)

The COVID-19 pandemic supercharged digital transformation initiatives at companies around the world, as the corporate version of the “fight or flight” syndrome kicked into high gear last year. Despite the real progress made on improving customer interactions, companies at the forefront of digital creation have not made similar advances in how they think about and manage their data, a KPMG report suggests.

In its new report titled “The Data Imperative,” KPMG makes the argument that companies in the technology, media, and telecommunications (TMT) sector–which are among the most technologically sophisticated companies on the planet–have not focused enough time and effort in creating data strategies, even as COVID-19 forced them to make significant investments in digital transformation.

“During much of COVID-19, the priority for many organizations was survival. To continue to serve customers, digital transformation efforts needed to accelerate,” writes Alex Holt, the global head of the TMT sector for KPMG. “Because of this, we hypothesized that focusing on digital transformation and data equally simply was not possible for most.”

Considering the speed at which companies of all stripes were forced to offer Web and mobile alternatives to traditional customer interaction channels, Holt wonders whether TMT companies even had time to think about “the vast and rich data assets that they were creating as a result of their accelerated transformations?”

To answer that hypothesis, and to dig deeper into questions about what a data strategy should entail in the era of digital transformation, KPMG commissioned HFS Research to query 300 executives at TMT companies in North America, Europe, and Asia Pacific.

The survey results support KPMG’s premise that the simultaneous existence of successful digital transformation and wholesale data strategies has been, to a large extent, mutually exclusive, at least among the TMT sector (and up to this point). It found that 57% of the companies surveyed lacked an “enterprise-level data strategy.”

Companies in the TMT space priortized digital transformation efforts ahead of data strategies (Source: KPMG)

About half of the executives surveyed strongly agreed that that “the pandemic derailed progress in data usage by shifting the urgent focus to cloud deployment, the critical underpinning of digital transformation,” KPMG said in its report. What’s more, 73% of respondents agreed that “as organizations rushed to survive and thrive, most did not have time to think through the treasure trove of data they were creating for themselves.”

Finally, four out of five executives at TMT companies agreed that “they are underutilizing their data volume for competitive advantage due to more pressing business issues related to the pandemic,” the report stated.

While companies crammed years’ worth of digital transformation progress into a few hectic months in mid-2020, the inability to come up with a plan to manage and harness all that data will have consequences. Development of machine learning, analytics, and AI initiatives are dependent on companies becoming “data first” organizations, KPMG says.

Only 29% of the companies it surveyed say they have a “comprehensive data strategy” implemented at scale across the enterprise or organization, while 44% say they are currently implementing one in a few areas (which is to say, it’s not a comprehensive strategy). It found 18% are planning to invest in such a strategy in the future, while 9% are currently piloting one.

KPMG found that only 11% of enterprises have implemented an enterprise data strategy before implementing a digital transformation effort. This is effectively putting the cart before the horse, the company says. “If data is the new oil–as it has been characterized by many for the last five years–priorities should be reevaluated.”

Obviously, COVID-19 disrupted many well-laid plans. Without the ability the adjust on the fly to the new business reality, many of these enterprises may not have survived. The pandemic was (hopefully) a once-in-a-lifetime event, and that’s even before considering the pre-existing competitive pressures, which one recent analysis found will likely result in half of the S&P 500 companies being kicked off the prestigious list within 10 years.

However, just because COVID churned the business waters doesn’t mean that digital transformation should be the all-consuming priority of businesses. KPMG encourages executives to think about the order in which they implement these next-gen business projects in a logical manner.

“While the pandemic reshaped many businesses’ roadmaps,” KPMG writes in the report, “it is important to remember that digital transformations can be a significant source for new datasets. At a minimum, data and digital transformation should be at the same priority level; in many cases, data should be ahead in the quest to drive true competitive differentiation.”

In the end analysis, many TMT companies have significant amounts of underutilized digital assets, KPMG found. And when you consider that TMT companies are at the high end of the curve, that doesn’t speak well of the companies in other industries that are much further down the curve.

In other words, there are a whole bunch of companies that have a whole bunch of data that they’re not using very well. This is the “data imperative” that KPMG hopes to highlight, with the hope that companies will start to think more holistically about data–from how they store it and govern it, to how they ultimately monetize it.

Some of the biggest trouble spots include using and analyzing structured and unstructured data, which 41% reported as a major challenge. Slightly less (39%) reported that distributed access to different data sources, such as internal fictional data, internal enterprise-wide and external data, is a challenge.

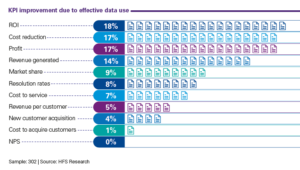

Which metrics TMT companies plan to use to measure the success of thier data strategies (Source: KPMG)

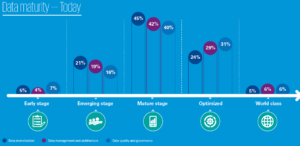

All told, only 10% of companies have a “world-class data strategy” at the moment, KPMG says, while 45% are in the mature stage. Within two years, at least 30% of companies hope to have a world-class data strategy, while KPMG expects more than 50% of companies to be in the mature stage.

The good news is that companies that have invested in data and achieved a degree of competency can expect to recoup those investments. More than half of the executives believe that total company revenues can grow by 4% or more by simply increasing their data investments by 25% (the average TMT company spent $66 million in data capital and expenses last year), the study found.

What’s more, 39% of the executives said data investments will have the highest returns of any tech-related investments over the next 12 to 24 months, the survey found. Among the top targets for data-related improvements were improvising transactional, operational, and backoffice systems; improving cybersecurity, improving the employee experience, supporting digital strategy and transformation, and improving overall executive decision making.

While the present is somewhat dim for data at TMT firms, as the pandemic recedes and companies take stock of their data situations, the future looks bright. “What this study shows is that TMT companies are underutilizing their data resources,” Holt said. “At the same time, they correlate a potential for outsized financial returns by leveraging data across all value chain activities.”

You can download a copy of KPMG’s report here.

Related Items:

Hallmarks of AI Success in the Enterprise

Cloud Migration Is a Boon to Operations. But It Creates a Perfect Storm of Data Challenges

The Data and AI Habits of Future-Ready Companies