Cloudera Rebounds in Q2, Beats Expectations

After a tough first quarter that led to the ouster of its CEO, Cloudera delivered better financial results in the second quarter, according to figures released this week. While the company is still running at a loss and has yet to name a permanent CEO, investors have turned bullish on the stock once again.

For the three months ended July 31, Cloudera reported total revenue of $196.7 million. That represented a 4.9% increase on the $187.5 million it recorded for the first three months of fiscal year 2020, and a win over the consensus estimate of $190.4 million in revenue.

Total operating expenses in the second quarter amounted to $228.7 million (down about $1 million from the first quarter). That translated to a net loss of $87.0 million on a GAAP basis (down from a $103.1 million GAAP net loss in the first quarter). On a per-share basis, it lost $0.02 per share versus, which handily beat the consensus estimate.

“We executed better in Q2, exceeding expectations on all our financial measures,” stated Marty Cole, Cloudera’s chairman and interim CEO. “Most importantly, we delivered an initial release of our cloud-native data management and analytics offering, Cloudera Data Platform.”

Cloudera has been under pressure to deliver since it completed its merger with Hadoop rival Hortonworks at the beginning of the year. Combined with the struggles of MapR, which has been acquired by Hewlett Packard Enterprise, questions about the future of Hadoop have dogged Cloudera, which is the last of the pure-play Hadoop distributors.

The publicly traded software company (NYSE: CLDR) has been trying to distance itself from Hadoop for years. You will remember how company co-founder and Chief Strategy Officer Mike Olson told an audience at Strata + Hadoop World five years ago that “we’re going to see Hadoop disappear.” Unfortunately for Cloudera, the connection between the yellow pachyderm and its software deliverables has been hard to shake.

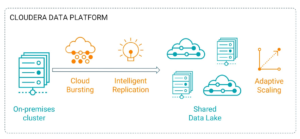

But Cloudera is still trying to shake off the Hadoop malaise. In three weeks, at the Strata Data Conference in New York City, we’ll hear the latest on the company’s ongoing transition to becoming a purveyor of a hybrid data platform that is equally at home running on-premise or in the cloud, which the company perceives as its key strategic advantage over AWS, Microsoft Azure, and Google Cloud (although the cloud vendors are building on-prem options). The company’s acquisition of Arcadia Data, which delivers a next-gen OLAP engine for data lakes, also figures to factor into the future conversation.

“We are focused on meeting our customers’ demands for hybrid and multi-cloud solutions that support use cases from the Edge to AI,” Cole stated in the press release. “That is the promise of CDP and the enterprise data cloud.”

In a call with analysts after the market’s closed Wednesday afternoon, Cole elaborated on the delivery of CDP. “We met the first milestone in the current quarter as last week we delivered initial releases of our CDP public cloud services,” he said, according to a transcript of the call on Seeking Alpha.

Cole, who some expect will be the next permanent CEO, offered some extra guidance on the company’s execution, which was the last straw in ushering predecessor Tom Reilly from the CEO’s position in June.

“…[O]ur internal metrics and pipeline generation have materially improved from Q1 levels,” he stated in the press release. “Together with solid execution in our second quarter, we are ‘on plan’ for achieving our objectives for this fiscal year.”

The CDP roadmap helped close deals in the second quarter, the interim CEO said. “Basic renewal activity rebounded in Q2,” Cole said during the call with analysts. “We executed better, resulting in fewer slip renewals than in Q1. We believe the improvement in renewals was helped in part by more clarity regarding the new Cloudera technology roadmap and greater certainty as to the composition and functionality of CDP.”

In June, the company forecasted revenue between $745 million and $765 million for the full 2020 fiscal year. That number has bumped up a tad, as the company is now giving guidance on full-year revenue to fall within the range of $765 million to $775 million. That $10 million increase is all attributable to subscription revenue, which the company says will come in at $635 million to $645 million of that.

That’s down significantly from March, when Cloudera submitted its first quarterly report following the completion of the merger with Hortonworks, when it gave full-year revenue guidance in the $835 million to $855 million range, on subscription revenue of $695 million to $705 million.

With so much bad news behind it, any increase in the outlook was taken as a sign that Cloudera’s outlook is improving. The report triggered a rally in the stock price. Yesterday the stock increased by 14% to $8.23, and today the stock is up about 6%. At least one investment bank, JMP Securities, has upgraded Cloudera.

Related Items:

Hitting the Reset Button on Hadoop