Data Growth Rate in U.S. Predicted to Slow

While data continues to pile up in unprecedented volumes, the rate of data generation in the U.S. relative to the rest of the world is predicted to slow in the coming years, according to a new report issued by IDC.

The amount of data generated in the entire world will grow from 33 zettabytes in 2018 to 175 zettabytes by 2025, according to the most recent Global Datasphere report that IDC and Seagate put together every year. That puts the compound annual growth rate (CAGR) of global data at 28% over the next five years, which is healthy if not astronomical (i.e. geometric) growth.

However, when IDC sliced the data forecast by country, they find that growth for the U.S. will actually lag the world as a whole. Specifically, they find that the U.S.’s share of the Global Datasphere is 21% today, but will drop to 17.5% by 2025. The CAGR for U.S. data is projected to be 23.6% over that period, nearly 4.5% lower than the globe as a whole.

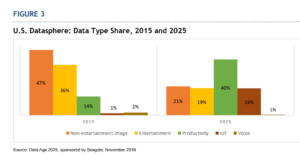

The cause for this drop in the delta, IDC says, is a slowdown in creation of entertainment-driven and imagery data here in the States relative to other data types.

IDC says that, while entertainment data will grow by a factor of 4.7 from 2015 to 2025, “it will be outpaced by growth in productivity (big data and metadata) and IoT such that entertainment data will fall from 36% of the [U.S.] Datasphere in 2015 to less than 20% in 2025,” IDC writes.

The slowdown will be occur, IDC says, because many of the analog-to-digital conversions in the media and entertainment industry will have been completed by 2025. There will also be a slowdown in the creation of image data tied to surveillance video and medical imaging in the coming years, IDC says.

“Like other regions, much of the growth [in the U.S.] will be driven by signals from IoT devices, metadata, and video surveillance,” IDC analysts John Gantz, David Reinsel, and John Rydning write. “However, growth in entertainment-driven data is slowing as productivity-related data accelerates.”

The China Datasphere is already the biggest in the world, and is also the fastest growing, according to IDC. Specifically, video surveillance programs, such as Project Dazzling Snow, and IoT data created as part of smart cities projects, will be responsible for large amounts of data creation in China in the coming years.

Just as it’s predicted to do in the U.S., the makeup of the datasphere in China is slated to change. IDC predicts Entertainment data – including data from digital TV, online videos, music, and games – to grow by a factor of 7.8 from 2015 to 2025. However, growth in that data type will be overshadowed by growth in productivity data and IoT. In fact, the categories will change so much that entertainment data will drop from 46% of the China Datasphere to about a quarter.

The Global Datasphere is changing the face of work and play on the globe. From superfast train surveillance systems to self-driving vacuum cleaners, data powers the globe in ways both big and small. We’re in the midst of that change right now, and businesses that figure out how to harness this data have an inherent advantage.

“Ultimately, in this new age of data, businesses are not just technology or software businesses first, but they are also information businesses first, ” IDC writes, “and will need to become data savvy to optimize the opportunities and mitigate risks using technologies and become data thrivers and gain a competitive advantage in the data-driven economy.”

Related Items:

Adaptability to Change Critical to Surviving Data Tsunami

Global DataSphere to Hit 175 Zettabytes by 2025, IDC Says

The Future of Storage: Hardware