Why Innovation Chains Require a Tech-First Approach

(Lightspring/Shutterstock)

During the heyday of the big data hype bubble, companies would invite criticism by spending large sums on emerging tech, such as Hadoop clusters, graph databases, and streaming analytics, before they had devised solid business plans around them. It was practical advice and it was given in earnest, but the scolding may have been wrong if new research into the emergence of technology innovation chains is accurate.

Forrester VP and principal analyst Brian Hopkins touched on the topic of innovation chains last month during his keynote speech at Hortonworks‘ Dataworks Summit, where he described how exponential growth factors described by various laws – including Moore’s Law, Metcalfe’s Law, and Bezos’ Law, not to mention the uncanny insights futurist Ray Kurzweil shared nearly 20 years ago – will culminate in a series of technological breakthroughs in the future that will transform how we work and live.

The current state of technological sophistication and the current rate of acceleration led Hopkins to conclude that we just entered the Bronze Age of Big Data, with the related silver, gold, and (hopefully) platinum ages yet to come. “When you think about what’s going on and the sustained business acceleration,” he said in the Dataworks keynote, “I think we are absolutely just getting started.”

In a follow-up interview with Datanami, Hopkins elaborated on his views about businesses’ relationship with technology, and specifically about the existence of technology innovation chains that will enable companies with aggressive technology adoption strategy to gain a strong competitive advantage.

Innovation Chains

Hopkins reiterated his view that having a conservative and risk-averse approach to technological adoption is not conducive to competitive success in the long-term.

“I touched on it lightly in my speech, but I avoided being overly provocative,” he said. “One of the things I talked about was how things like the Gartner Hype Cycle and ‘crossing the chasm’…invite the majority to sit back and wait. ‘Let’s let the hype die. Let’s let the bleeding edge cross the chasm first and we will jump in when we’re ready, when the technology is more mature.’

“The point I was trying to make was, if the leaders are accelerating because they’re riding these waves of exponential trends driving new disruptive breakthroughs based on software innovation, you’re not going to be able to catch them, because they’ve invested in the chain. They’ve invested in the infrastructure, they’ve invested in the big data, they’re invested and are doing this in the cloud, and they’ve invested in AI. And all these things are now accelerators for driving things faster than companies that haven’t made the foundational investment in the whole chain.”

Companies that wait to adopt today’s crop of cutting-edge technologies until they’re standard IT fare run the risk of being out-innovated by faster and nimbler firms, he said.

“We think that the time for sitting back and waiting to be a fast follower only works if you have a really good engine, and when you hit the gas and accelerate, you actually can,” Hopkins said. “The problem is most fast followers….aren’t fast followers. The majority don’t make the necessary investment to have that platform to enable them to accelerate.”

Breakthrough Innovation

Rather than focus all of one’s attention on how a specific piece of technology – such as deep learning, Internet of Things, distributed ledger platforms, robotic process automation, the cloud, quantum computing – can be applied in one specific project, Hopkins encourages businesses to instead consider how families of related technologies can work together to deliver a breakthrough innovation.

“What I’m trying to say in the innovation chain research is don’t over-focus on that one emerging technology,” he said. “There’s a bunch of different things that work together in a chain to accelerate driving innovation and disruption with software.

“Software is driving the cost of innovation to zero. Big data analytics is driving the cost of analyzing and understanding the world relentlessly towards zero,” he continued. “So these exponential trends are driving or making change faster, making us more agile, letting us know the world more. And they’re working together in these chains, so you have to invest in the chain, to make sure the pointy tip, that breakthrough solution, actually works like you want it to and gives you a competitive edge.”

Hopkins discussed his idea about chains of technology driving innovation with some folks at Google, and received a welcome reception from the Mountain View, California crew. “Their response was ‘That’s exactly right, that’s exactly what we’re doing. Nobody had named it before,'” he said.

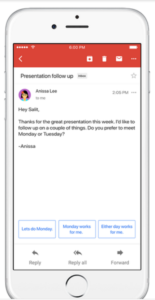

One example of an innovation chain delivering a “pointy tip” breakthrough is Smart Reply, a feature that Google built into the Gmail inbox to automatically reply to users’ emails. There’s obviously some natural language processing (NLP) and fancy linguistic machine learning going on in there, but it turns out there’s much more to it than that, according to Hopkins.

“The way that they did it is they had to build upon all the cloud foundation, all the stuff in Google Cloud Platform, that they’ve invested in for years,” Hopkins said. “To do semi-supervised machine learning they needed Tensorflow, so they had to build the Tensorflow machine learning framework. Then had a graph database called Expander. They had to invest in that technology.”

Building something like Smart Reply, which now accounts for 13% of emails in Gmail, would not be possible if Google hadn’t already invested in all the supporting technologies or was currently investing in them, Hopkins said.

“One could look at this and say, ‘It’s AI! I just need AI!’ But in reality they had cloud, they had big data, they had graph databases. They had all these things that enabled them to do that,” he said.

“So if you’re just sitting back and going, ‘Oh I just want to buy a box!’ you’re missing the point of what Google and these other leaders are doing, which is making these foundational investments systematically over years, so when they want to do something truly innovative and disruptive, they have the underlying chain of stuff, the related foundation, in place.”

Big Getting Bigger

Having prior investments and expertise in those various technologies gives Google an “enormous advantage” over would-be competitors, Hopkins said.

But that doesn’t mean that every mid-size distributor of fresh produce or specialty electronics manufacturer should closely emulate Google by going out and spending tens of millions of dollars to hire all the top people in deep learning, blockchain, IoT, robotic process automation, cloud automation, quantum computing, and every other emerging technology that could contribute to a breakthrough down the road.

“We’re not suggesting that,” Hopkins said. “We’re suggesting that you can look at some of the way that Google work and bring a few of those into how you think about things.”

Google, Amazon, and the rest of the FANG gang have an enormous head-start in the technology department, and Hopkins doesn’t sound optimistic that they’ll ever give it up. In fact, Hopkins sees these tech firms using their investments in innovation chains and big data (which is necessarily for training machine learning algorithms) to form a competitive barrier that protects them. He cites recent Census data that suggest big companies are getting bigger, and that the share of hiring by big companies is getting bigger.

“That kind of flies in the face of ‘If you’re a large business you’re doomed because some small digital disrupter is going to unseat you.’ Quite the opposite is true at this point in the economy right now,” he said.

Big companies have the advantage of deeper pockets to invest in innovation chains, but that doesn’t automatically mean they’ll come out the winners. “You have to be a bigger company of a certain type,” Hopkins said. “The world is littered with large companies that haven’t invested in the right technology platform or haven’t invested in the right innovation chains, and are going to struggle and die.”

Amazon, specifically, poses a huge threat to other big companies in adjoining markets, because it can take its investments in data and technology and apply them quickly. That is a new problem, Hopkins said. “The worry, if you’re a big business, is that another big business that’s made better software and technology investments than you decides to move into your market, because they can,” he said. “That’s the worry.”

Related Items:

Power Laws and the Never-Ending Big Data Boom

One Deceptively Simple Secret for Data Lake Success