Predictive Analytics Drives Profits for Insurers, Study Shows

A study conducted by Valen Analytics found a strong correlation between the use of data analytics and predictive modeling and superior profitability among insurance companies.

Valen Analytics yesterday released the results of its third annual return on investment (ROI) study of its own customers. The Denver, Colorado-based company, which provides data, analytics and predictive modeling capabilities to insurance companies, says the ROI figures are strong evidence that taking a data-driven approach to writing policies has a direct and positive impact on business.

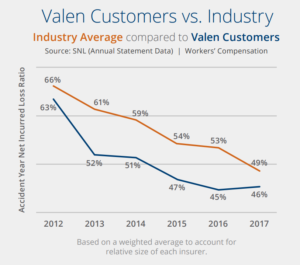

The study’s conclusions hinge on two main metrics: losses resulting from insurance claims (which roughly corresponds with profitability) and top-line revenue growth from insurance premiums. The data was taken from 20 of Valen’s worker’s compensation customers from 2012 to 2017, and compared against industry averages.

The company’s study found that, while the industry as a whole improved its loss ratios by an average of 18% from 2012 to 2017, its clients’ loss ratio improved even more — by 3% to 9% compared to that average. What’s more, its clients grew their direct written premiums by 53%, significantly more than the market average of 18% growth during that time.

While overall industry premiums

were down slightly in 2017 compared to 2016, carriers that adopted analytics saw their premiums rise 4% for the year, according to the company.

“The results of our studies have repeatedly quantified the unparalleled top and bottom line results for data-driven insurers,” says Kirstin Marr, president of Valen Analytics, which is a subsidiary of Insurity. “This year, we’ve taken the data further to display how our customers consistently grab profitable market share and beat the competition by more accurately aligning price to the risk exposure.”

While the insurance industry is generally conservative and risk-averse by nature, it has been rapidly moving to adopt analytics over the past few years. The positive results of a few early-movers – including Progressive, which rolled out its Snapshot data-gathering device in 2014 –led to more widespread adoption of predictive modeling in the $500-billion property and casualty (P&C) insurance industry.

Specifically, insurance companies are benefiting from the capability to use many more variables in their models – up to 1,000 variables, in some cases – to give them much more fine-grained predictive power over smaller segments of the population. As Valen’s data shows, insurance companies that have not yet adopted analytics are losing ground to those that have.

Related Items:

How Big Data Analytics Is Shaking Up the Insurance Business

Insurer Embraces Data Analytics to Shape Benefits Coverage