Wall Street Firm Seeks Small Data Antidote to Big Market Excesses

The advent of algorithmic trading has fundamentally changed Wall Street. Instead of guys in blue suits buying or selling in the pit, complex algorithms developed by Ivy League quants continually execute trades based on little blips in the data. Considering how high speed traders eat the average investor for lunch, it begs the question: Has the world of algorithmic trading gone too far?

One Wall Street firm by the name of Huygens Capital believes big-data powered trading is not always in the best interest of the client. But instead of giving up on algorithms, the firm has designed a unique “robo advisor” that utilizes relatively small sets of data to make predictions about the stock market.

Everybody wants to beat the market, which is a really hard to do on a regular basis. But as Huygens Capital CEO and founder Walter Vester sees it, a tactfully designed algorithm combined with a carefully applied investing strategy may get you close.

“We’re not fans of high-frequency trading,” says Huygens Capital CEO and founder Walt Vester. “Our view is that we can do the best for our clients by trading for them as infrequently as possible.”

Born of Big Data

Vester founded Huygens in 2011 following a unique career path. With a bachelor’s degree in computer systems and engineering and a master’s in electrical engineering and applied physics, he wrote algorithms the military used in covert, long-haul radio communications. He then took his quantitative skills to AllianceBernstein, a global asset management firm with nearly $500 billion under management.

At AllianceBernstein, Vester got his first taste of robo advisors, a class of computer programs that basically manage portfolios on behalf of clients. Vester wasn’t impressed with their results. “The pitch to their client is, ‘We’ve got a computer doing this and a computer doesn’t cost very much, so we’re not going to charge you much,'” he says. “The downside is their performance isn’t spectacular. They’re just giving you a portfolio of average returns.”

The typical robo-advisors also doesn’t have any means of protecting against downside risk in the market. That, combined with the excesses he witnessed in algorithmic trading, created the kernel of an idea that would lead to the founding of Huygens.

Retreat to Safety

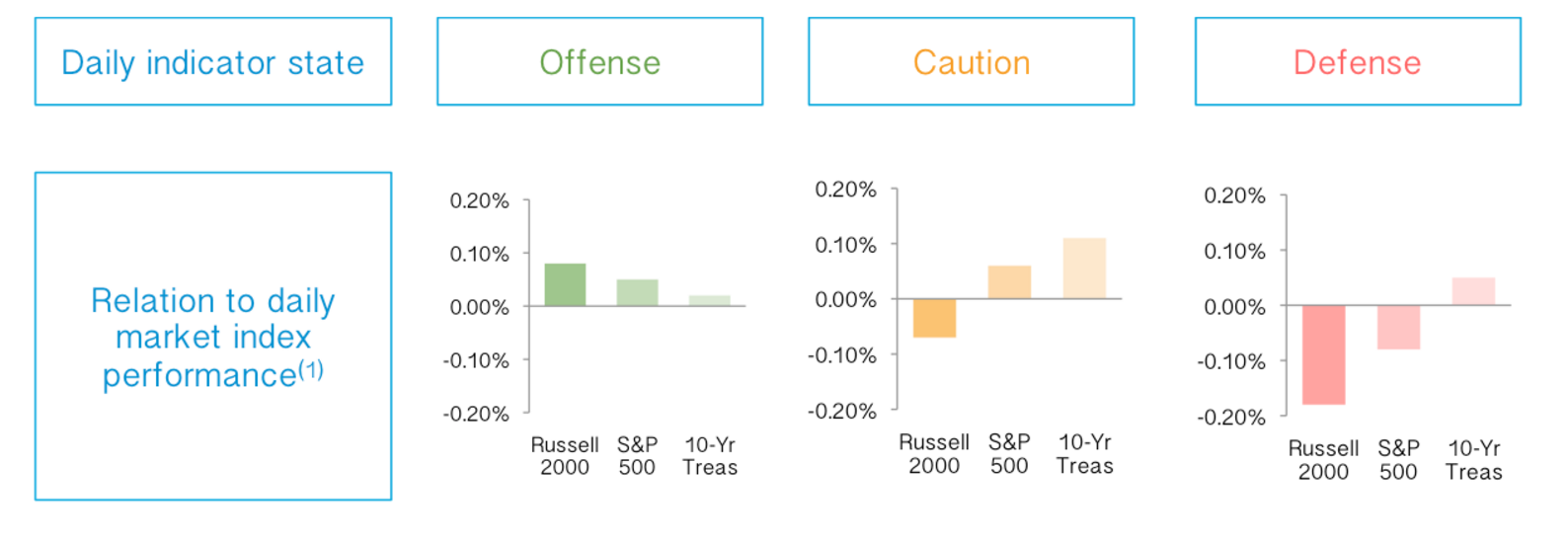

Huygens’ investment strategy is relatively simple. After the market closes every day, a specially designed algorithm goes to work, crunching the latest market figures to predict the volatility in the equity market for the following day.

If the algorithm predicts low volatility, Huygens goes on offense and invests its clients’ money (minimum investment: $20,000) in U.S. equities. When the algorithm detects high volatility, it goes on defense and invests in U.S. government bonds. When the algorithm gives a mixed response, it goes into caution mode, and invests in bonds.

Vester says there are just a handful of inputs into the algorithm, the biggest one being the price of S&P 500 put options, which is a commonly used hedging instrument used by major institutional money managers.

“What we look at is the relative price of those hedging instruments over time,” he says. “When the institutional money manger is deciding that there’s so much risk out there that they’re willing to pay a lot for a hedging instrument, they are not going to be a buyer of equities, and that’s an indicator that the supply and demand for equities is probably going to be imbalanced and you’ll have this excess of selling activities.”

“What we look at is the relative price of those hedging instruments over time,” he says. “When the institutional money manger is deciding that there’s so much risk out there that they’re willing to pay a lot for a hedging instrument, they are not going to be a buyer of equities, and that’s an indicator that the supply and demand for equities is probably going to be imbalanced and you’ll have this excess of selling activities.”

Dangerous Correlations

When Vester set out to devise the algorithms that would power his new robo-advisor at Huygens, he took pains to ensure that he wasn’t going down the same path as others on Wall Street. That meant avoiding some of the potentially dangerous situations that over-reliance on big data’s predictive power can lead to.

“Investment systems are probably one of the areas people have applied big data the most, from neural networks to Marcov models–all sorts of things,” Vester says. “Big data is a blunt instrument that can really be dangerous if improperly used.”

For example, some traders on Wall Street are mining Twitter feeds for information, or keeping track of thousands of sets of time-series data, looking for correlations to exploit. There may be patterns that appear, but all too often, they will lead to a dead end.

“The risk is correlation does not equate to causality,” Vester says. “You can find lots of different time series that look great in history, but have no predictive capability. There are lots of systematic investment approach that over fit the data in that way and really get you into trouble.”

Still Room for Algo

That’s not to say you can’t find worthy signals in all the noise. After all, Vester thinks he has found a big one that his research shows does quite well at maximizing returns while protecting against downside risk.

Vester is quite open about his strategy, which lies in stark contrast to the secretive nature of most quantitative strategies on Wall Street. In fact, the company publishes the results of its algorithm on its website every day—after it has already used the information for its paying clients, of course. “Rather than stay stealthy, we think it’s more important to get the word out,” Vester says.

Vester doesn’t seem to care if others try to emulate Hugyens strategy. The predictive power of the relative price of hedging instruments has been studied for decades, if not implemented widely. The depth and liquidity of that particular market gives Vester assurance that his clients will be able to benefit from this strategy even if others are doing the same, he says.

Vester doesn’t seem to care if others try to emulate Hugyens strategy. The predictive power of the relative price of hedging instruments has been studied for decades, if not implemented widely. The depth and liquidity of that particular market gives Vester assurance that his clients will be able to benefit from this strategy even if others are doing the same, he says.

However, that’s not to say that reproducing Huygen’s algorithm would be easy. “You have to do a parameter optimization to figure out how important that is relative to other factors,” Vester says. “So it becomes less of an unsupervised pattern recognition problem, and more of a typical parameter optimization pattern, because the structure of the data and its relationship to the outcome is already known.”

How well does this approach work? The truth is, it’s hard to tell. The algorithm is designed primarily to protect assets during market downturns, but we’ve been in a bull market for the entire time Huygens has been around.

The firm’s indicator switched from offense to defense during the market turbulence in August, but it quickly switched back to offense when things settled down. “There hasn’t been a meaningful sell off in S&P 500 in years,” Vester says. “A 10 percent sell off in the S&P 500 occurs once, on average, every couple years. The bigger sells offs–15 percent or more–that’s where our system is really designed to outperform.”

Only time will tell if Huygens strategy pays off. The company rarely trades—it changed the investment mix just 14 times in all of 2014, making it a “low-frequency trader,” if you will. As a trained equity analyst, Vester doesn’t see much upside left in the historic bull run, so perhaps his clients will find out soon.

Related Items:

How Big Data Is Changing How Businesses Use The News

How Machine Learning Is Eating the Software World

U.S. Enlists Big Data to Fight Securities Fraud

(feature image: Rawpixel/Shutterstock.com)