Forget Big Data–Small Data Is Where the Money Lies

Big Data continues to be a big topic. Experts promise a world where the Internet of Things (IoT) proliferates and tiny, inexpensive sensors collect massive amounts of data. New, powerful databases coupled with information storage technology and analytical tools offer the promise of gleaning amazing insights and finding patterns we never before imagined.

However, for most businesses, it’s still too early to become actual practitioners of Big Data. Some may remember the 2013 findings from research organization SINTEF that 90% of the world’s data has been created in just the past two years. This is, to put it lightly, a bit overwhelming, and the even more overwhelming consideration is that this enormous amount of data is compounding with each passing day. Most companies–especially those outside the Fortune 500–simply do not have the technological or financial resources to invest in the collecting, storing and analyzing of this volume of data. And even if they did, the applications aren’t there yet.

Business intelligence (BI) tools are, unfortunately, not the answer here. Many legacy BI solutions require year-long integration periods, substantial financial resources and in-house analysts to manage the technology and decipher the resulting reports. But more importantly, BI vendors are not Big Data vendors. The term BI has evolved into a cloudy one, with more and more companies attaching themselves to the concept simply because it’s in vogue. But BI solutions ≠ Big Data providers.

The fact is, for the majority of small and medium businesses, Big Data is the technology of the future, not the reality they experience today. To be blunt, most SMBs don’t even have a handle on the Small Data they’re already creating and collecting themselves. (And if many enterprise organizations are  being honest, neither do they.) According to Forrester Research, most companies are analyzing a mere 12% of their existing data. That leaves a whopping 88% of data that businesses are flat out ignoring. Can you imagine the potential of actually leveraging that existing data to derive data-driven business insights? Instead of chasing the Big Data dream, SMBs should consider picking up the dollars that are effectively lying on the floor, and invest first in leveraging their Small Data.

being honest, neither do they.) According to Forrester Research, most companies are analyzing a mere 12% of their existing data. That leaves a whopping 88% of data that businesses are flat out ignoring. Can you imagine the potential of actually leveraging that existing data to derive data-driven business insights? Instead of chasing the Big Data dream, SMBs should consider picking up the dollars that are effectively lying on the floor, and invest first in leveraging their Small Data.

What is Small Data?

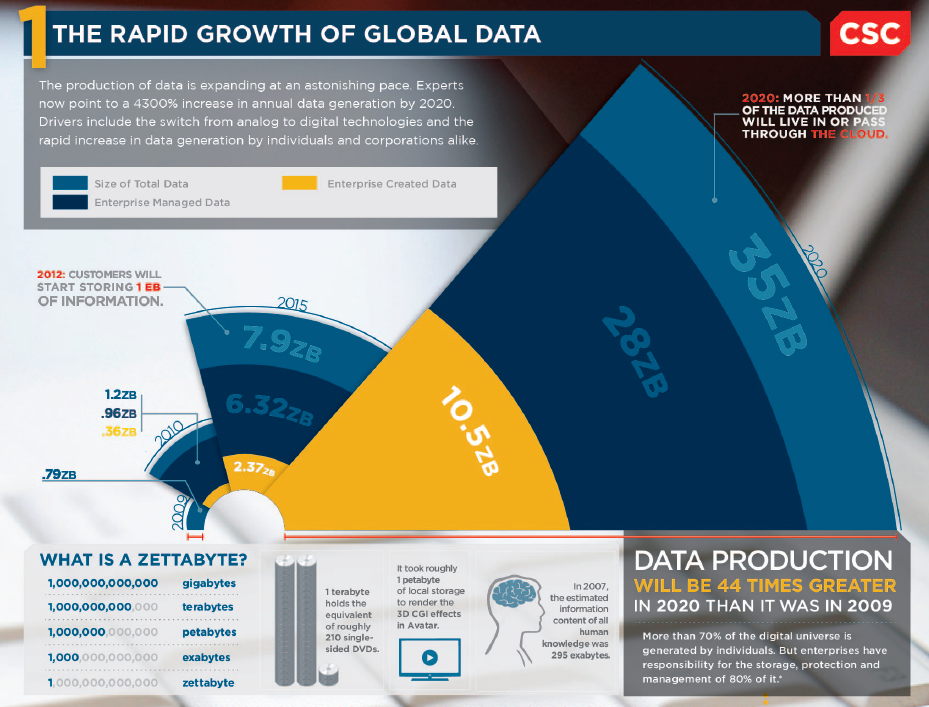

Small Data is everything Big Data is not. The concept of Big Data arose when a large separation grew between the rate of data processing advances and the rate of data growth. (See Computer Science Corp.’s take on the rapid growth of global data; you can download the entire infographic in PDF format here.)

Technologies and techniques are filling the gaps to allow us to leverage the massive and growing amounts of data we collect. However, because the term Big Data has been so popularized, many things that are not Big Data are still being labeled as such. Here are a few ways I differentiate Big Data:

You Might Not Be Big Data If:

- You were generated through human data entry. (Big Data came about in order to handle the exponential growth of machine-generated data, because we humans aren’t fast enough to outpace a good old relational database).

- You are an operational database. For instance, CRM is never Big Data, and ERP is never Big Data.

- You fit just fine in a MySQL database. Even if you have to put a lot of RAM in it, it’s still not Big Data.

Because of all the hype and potential surrounding Big Data, Small Data is often overlooked and under-leveraged. While Big Data is the promise of tomorrow, Small Data is what will generate cash for SMBs today. Small Data has the power to help businesses improve operational processes, increase ROI and drive better performance across entire organizations. Effectively leveraging Small Data can help sales teams increase their win-rates, improve their pipeline values and more accurately forecast sales goals. Small Data can help marketing teams objectively measure conversion rates and better segment their leads. Effectively leveraging Small Data can even enable SMBs to hire more effectively and get financing.

For every calorie of effort SMBs put into analyzing Small Data, there are impressive paybacks. In fact, a Nucleus Research study shows that an incremental 241% ROI can be generated by applying data to business decisions. And the best part is that your Small Data already exists. Analyzing that Small Data can take just 24 hours, it doesn’t have to cost a fortune to implement the necessary technology, and it doesn’t require SMBs to have data scientists or analysts on staff.

Becoming a Data-Driven Company

While Small Data is more accessible than Big Data, you still have to make changes to your business in order to start utilizing it effectively. In order for your business to achieve better results, you must first become a data-driven organization. This requires you to change the way your company operates from the top executives down to entry-level employees. You must:

- Adopt technology to harvest existing data

- Create a culture of data transparency

- Set measurable goals

- Hold your team accountable using metrics

The first step–adopting the technology–might be the easiest. There are a number of cloud-based, software as a service (SaaS) products that can extract your data and give you near-immediate access to an array of actionable (and decipherable!) reports. Whether you want to know your revenue growth over time, your average sales cycle, or your customer acquisition costs, Small Data can give you that knowledge. Crucial first steps, however, include determining what business problem or problems you want to solve with this technology, what key performance metrics (KPIs) are most important to measure, and ensuring that your entire organization understands these goals.

The second step–creating a culture of data transparency–makes all the difference between establishing an average business and a data-driven business. It can be difficult for many companies to allow every employee to access sensitive business data. However, you need to have true transparency in order to have true accountability to the data-driven goals you set for your team. (I know this may sound crazy to some, but at my own company I give every employee access to all of our board materials and all department goals and metrics. I do this because it empowers our company to think quantitatively, not qualitatively, and it propels objective, data-driven conversations across all departments).

The third and fourth steps are crucial for long term, data-driven success. Rather than just forcing employees to use analytical tools, empower them to use them. Empower every employee to be a mini-CEO, where they take ownership and run their own area of the business. They should make commitments to reach a certain metric that measures performance, explain why they commit to that goal, and then be held accountable to it. Initiating a data-driven culture shouldn’t (and can’t) be done with a stick, or by a single mandate. Develop a cadence of weekly 1-on-1s with all employees to ask data-driven questions and demand data-driven answers. By taking personal responsibility for their metrics-driven goals, you will see massive improvements in each employee’s performance.

Small Data can offer enormous business value, and I urge organizations to think differently about data analysis in order to best leverage it. Analyzing Small Data isn’t just about spreadsheets, tools or numbers. It’s about using quantitative, objective measurement to drive all company conversations. In doing so, you’ll enable your sales team to become more efficient in closing deals. You’ll push your customer service team to close tickets more quickly, and you’ll help your marketing team spend less money to acquire new leads. With a culture of data-driven transparency, Small Data can help your business save money, work more efficiently and grow faster.

With a culture of data-driven transparency, Small Data can help your business save money, work more efficiently and grow faster.

About the author: Fred Shilmover is the founder and CEO of business analytics provider InsightSquared. Prior to InsightSquared, Fred headed global IT and was an associate at Bessemer Venture Partners. His background includes an SMB consultancy he founded as well as corporate development at Salesforce.com. Fred has a B.A. from Tufts and an MBA from Harvard Business School.